ATO Interest Charges Are No Longer Deductible – What You Can Do

By WSC Group | Created on October 2, 2025

Leaving debts outstanding with the ATO is now more expensive for many taxpayers. General interest charge (GIC) and shortfall interest charge (SIC) imposed by the ATO is no longer tax-deductible from 1 July 2025.

Employees incorrectly treated as independent contractors

By WSC Group | Created on October 2, 2025

The ATO is warning businesses that if they incorrectly treat an employee as an independent contractor, then they risk receiving penalties and charges.

Reminder of September Quarter Superannuation Guarantee ('SG')

By WSC Group | Created on October 2, 2025

Employers are reminded that employee super contributions for the quarter ending 30 September 2025 must be received by the relevant super funds by Tuesday, 28 October 2025.

Correctly dealing with rental property repairs

By WSC Group | Created on October 2, 2025

Taxpayers who have had work done on their rental property should ensure the expense is categorised correctly to avoid errors when completing their tax return.

Small Business Superannuation Clearing House is closing

By WSC Group | Created on September 3, 2025

The Small Business Superannuation Clearing House ('SBSCH') will close on 1 July 2026.

ATO AFCX data-matching program

By WSC Group | Created on September 3, 2025

The ATO will acquire relevant account and transaction data from the Australian Financial Crimes Exchange ('AFCX') for the 2025 to 2027 income years, including the following:

Superannuation guarantee: due dates and considerations for employees and employers

By WSC Group | Created on September 3, 2025

On 1 July 2025 the superannuation guarantee rate increased to 12% which is the final stage of a series of previously legislated increases. Employers currently need to make superannuation guarantee (SG) contributions for their employees by 28 days after the end of each quarter (28 October, 28 January, 28 April and 28 July). There is an extra day’s allowance when these dates fall on a public holiday.

Non-compete clauses: the next stage

By WSC Group | Created on September 3, 2025

Back in March this year the Government announced its intention to ban non-compete clauses for low and middle-income employees and consult on the use of non-compete clauses for those on higher incomes. The Government has indicated that the reforms in this area will take effect from 2027. This didn’t come as a complete surprise as the Competition Review had already published an issues paper on the topic and the PC had also issued a report indicating that limiting the use of unreasonable restraint of trade clauses would have a material impact on wages for workers.

ATO to include tax 'debts on hold' in taxpayer account balances

By WSC Group | Created on September 3, 2025

From August 2025, the ATO is progressively including 'debts on hold' in relevant taxpayer ATO account balances.

RBA cuts rates to 3.60%: what this means for you

By WSC Group | Created on September 3, 2025

In a widely anticipated move on 12 August 2025, the Reserve Bank of Australia (RBA) delivered a 25 basis point rate cut, lowering the cash rate from 3.85% to 3.60%, the third reduction this year. This rate is now at its lowest level since March 2023 signaling renewed monetary easing amid persistent economic fragility.

PAYGW reminders for activity statement lodgments

By WSC Group | Created on September 3, 2025

The ATO will be sending certain employers a reminder to lodge their activity statements.

Creating a more dynamic and resilient economy

By WSC Group | Created on September 3, 2025

The Productivity Commission (PC) has been tasked by the Australian Government to conduct an inquiry into creating a more dynamic and resilient economy. The PC was asked to identify priority reforms and develop actionable recommendations.

A win for those carrying student debt

By WSC Group | Created on September 3, 2025

In support of young Australians and in response to the rising cost of living, the Australian Government has passed legislation to reduce student loan debt by 20% and change the way that loan repayments are determined. This should help students significantly more than the advice from outside of Parliament - cut down on the smashed avo.

Getting the main residence exemption right

By WSC Group | Created on September 3, 2025

The ATO has the following tips for taxpayers in relation to the CGT main residence exemption.

ATO warns of common Division 7A errors

By WSC Group | Created on August 15, 2025

The ATO reminds shareholders of private companies that understanding how Division 7A of the tax legislation applies is crucial to avoiding costly tax consequences when accessing the company's money or other benefits.

Taxpayer's claim for travel expenses denied

By WSC Group | Created on August 15, 2025

In a recent decision, the Administrative Review Tribunal ('ART') denied an offshore worker's claim for work-related travel expenses, although it did allow his claim for home office expenses.

Taxpayers who need to lodge a TPAR

By WSC Group | Created on August 15, 2025

Taxpayers may need to lodge a Taxable payments annual report ('TPAR') online by 28 August if they have paid contractors to provide any of the following services on their behalf.

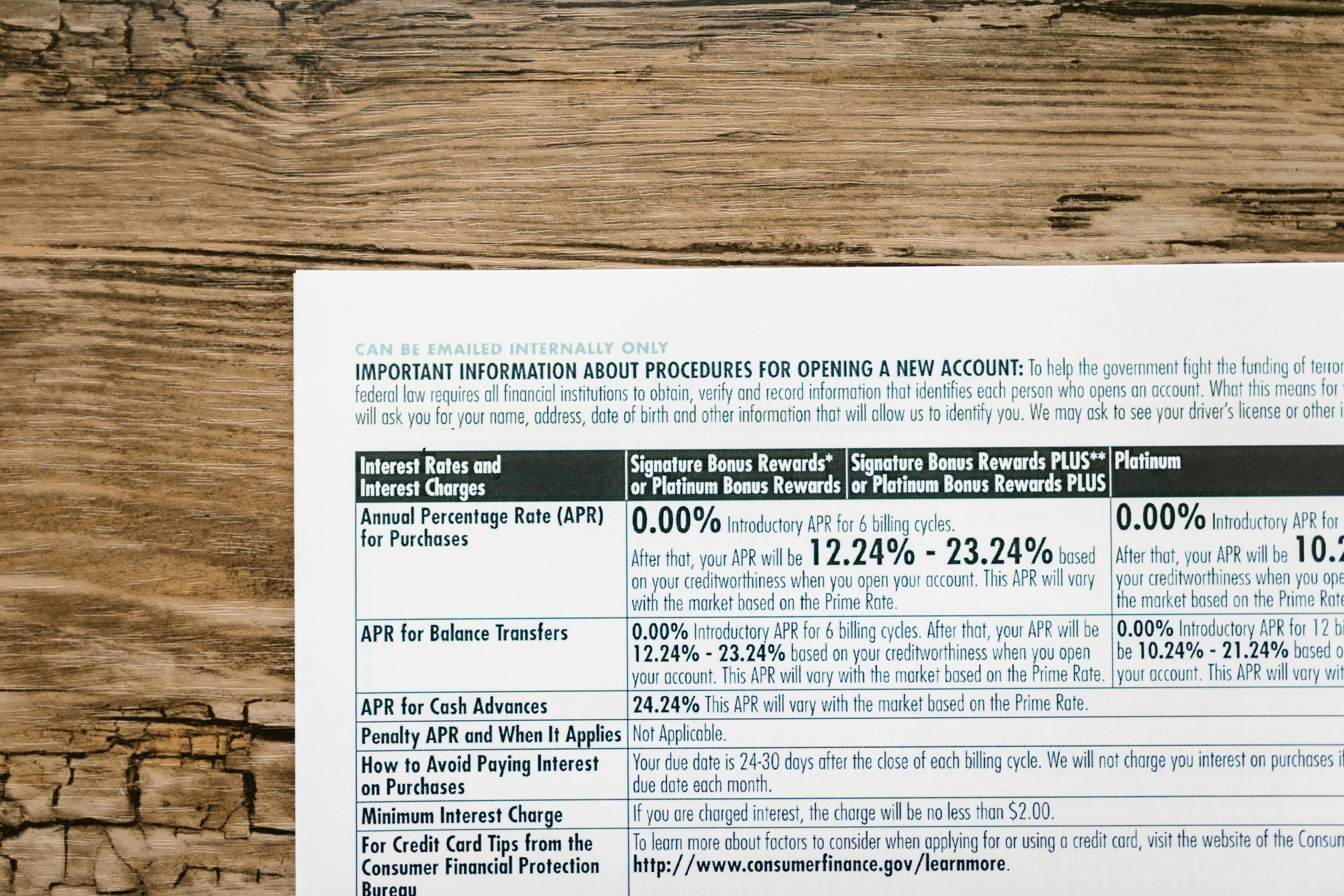

Interest deductions: risks and opportunities

By WSC Group | Created on August 15, 2025

This tax season, we’ve seen a surge in questions about whether interest on a loan can be claimed as a tax deduction. It’s a great question as the way interest expenses are treated can significantly affect your overall tax position. However, the rules aren’t always straightforward. Here’s what you need to know.

RBA Holds Rates at 3.85%: what this means for your business strategy

By WSC Group | Created on August 15, 2025

In a move that surprised many commentators, the Reserve Bank of Australia (RBA) held the cash rate steady at 3.85% in July. A show of caution over action, amid mixed economic signals.

Changes to tax return amendment period for business

By WSC Group | Created on August 15, 2025

Businesses with an annual aggregated turnover of less than $50 million now have up to four years from the date of their tax return assessment to request amendments (increased from two years).

Luxury cars: the impact of the modified tax rules

By WSC Group | Created on August 15, 2025

With the purchasing of luxury vehicles on the rise it’s important to be aware of some specific features of the tax system that can impact on the real cost of purchase.

Superannuation rates and thresholds updates

By WSC Group | Created on August 15, 2025

From 1 July 2025, the superannuation guarantee (SG) rate officially rose to 12% of ordinary time earnings (OTE). This is the final step in the gradual increase legislated under previous reforms.

Paid parental leave changes have now commenced

By WSC Group | Created on August 15, 2025

As from 1 July 2025, the amount of Paid Parental Leave available to families increased to 24 weeks, and the amount of Paid Parental Leave that parents can take off at the same time has also increased from two weeks to four weeks.

ASIC warning about pushy sales tactics urging quick super switches

By WSC Group | Created on August 15, 2025

ASIC is warning Australians to be on 'red alert' for high-pressure sales tactics, click bait advertising and promises of unrealistic returns which encourage people to switch superannuation into risky investments.

Taking charge of upcoming employer obligations

By WSC Group | Created on July 16, 2025

As the end of the financial year has just past, the ATO is reminding employers that they should check what they need to do and take note of the following upcoming key dates.

Trust funds: are they still worth the effort?

By WSC Group | Created on July 16, 2025

For decades, trust structures have been a cornerstone of the Australian tax and financial system, prized for their asset protection and flexibility when it comes to income distributions.

Notice of data exchange for skilled visa program compliance

By WSC Group | Created on July 16, 2025

The Department of Home Affairs will obtain data from the ATO to identify whether business sponsors are complying with their sponsorship obligations (e.g., paying visa holders correctly) and whether temporary skilled visa holders are complying with their visa conditions (e.g., to work only for an approved employer).

Div 296 super tax and practical things to consider

By WSC Group | Created on July 16, 2025

Division 296 super tax is a controversial Federal Government proposal to impose an extra 15% tax on some superannuation earnings for individuals if their total superannuation balance (TSB) is over $3 million as at 30 June of the relevant income year.

The one big, beautiful bill that may not be so beautiful for Aussies

By WSC Group | Created on July 16, 2025

You may have seen the viral headline about a new U.S. tax bill called the One Big Beautiful Bill, but what does it mean for Australian investors, especially super funds and small businesses with US exposure? Turns out, it could mean a hit to investment returns.

Taxpayer's claim for home office and car expenses successful

By WSC Group | Created on July 16, 2025

The Administrative Review Tribunal ('ART') recently held that a taxpayer was entitled to claim deductions for home office and car expenses incurred during the COVID-19 pandemic.