March 2018

Autumn is here, and not a moment too soon after a prolonged heatwave over summer. The Winter Olympics provided some welcome relief from the heat at home, and even though we failed to score gold at Pyeongchang we came away with two silver medals, one bronze and some promising young athletes to celebrate.

In the US, there was relief when the US Federal Reserve reported to Congress on February 23 that it was comfortable with the inflation outlook and not inclined to lift rates more than three times this year. Global shares stabilised after their recent volatility.

In Australia, the Reserve Bank has indicated rates are likely to remain on hold for some time to encourage wage growth. Reserve Bank Governor Phillip Lowe told the House of Representatives Standing Committee on Economics he would like to see wage growth of 3.5 per cent. Instead, the Wage Price Index rose 2.1 per cent in the year to December, just above inflation of 1.9 per cent, with public sector wages (up 2.4 per cent) growing faster than private sector (1.9 per cent).

On a positive note, corporate profits were solid in the six months to December, with a record 94 per cent of companies reporting a profit, although only 57 per cent lifted profit. Unemployment fell from 5.6 per cent to 5.5 per cent in January and consumer sentiment continues to recover. The ANZ/Roy Morgan consumer confidence rating rose 2.3 per cent in the final week of February to 117.9, well above the historic average. The strengthening US dollar saw the Aussie dollar fall from over US81c in January to around US78.5c by the end of February.

Home and away with super

Australians buying their first home or downsizing in retirement are about to receive a helping hand thanks to new superannuation rules which come into effect on July 1. From that date, first home buyers will be able to contribute up to $30,000 into their super fund towards a home deposit while downsizers can put up to $300,000 of the proceeds of selling the family home into super.

This new measure has been devised to assist first home buyers, many of whom have struggled to save a deposit as rising prices put even entry level properties out of reach.

At the other end of the scale, the change is envisaged to help older homeowners who frequently find themselves in large houses while trying to survive on a modest super balance or the aged pension.

Here’s how the Federal Government hopes to improve the situation at both ends of the property market.

Buying a home

Under the new First Home Super Saver (FHSS) scheme, individuals can arrange for up to $30,000 to be deducted from their pre-tax income and put in their super account. They can then withdraw 85 per cent of that money ($25,500), plus any interest they’ve earned on it, to use for a home deposit. In the case of a couple, both partners can save $30,000, meaning a deposit of $51,000 (i.e. 85 per cent of $60,000) plus interest can be accumulated.

So what's the catch?

It's complicated.

For starters, individuals can only contribute $15,000 into their FHSS account in any one year. What’s more, the compulsory 9.5 per cent super contributions made by employers can’t be accessed; additional voluntary contributions need to be made. The annual contributions cap of $25,000 cannot be exceeded; this includes all voluntary contributions plus employer’s Super Guarantee contributions.

When the money is withdrawn, it is taxed at the individual’s marginal tax rate minus a 30 per cent tax offset. Effectively, that means most people will pay little or no tax although higher-income earners on high marginal rates will still pay some tax.

Selling a home

Under the Downsizer Super Contribution Scheme (DSC), homeowners who are 65 or older can put up to $300,000 of their home sale proceeds into their super provided it’s their place of residence and they’ve owned it for at least 10 years. In the case of a couple, both partners can deposit $300,000 (collectively $600,000) into super.

What's the catch?

Unless you're a wealthy retiree looking for a tax break there doesn’t appear to be one. For those who already have more than $1.3 million in super, adding a $300,000 downsizer contribution will breach the $1.6 million balance transfer cap which is the maximum balance that can be held in a tax-free super pension account. Given the current generation of Australians have been retiring with average super balances of well under $300,000, that is unlikely to be an issue for most downsizers.

What do you do now?

If you are looking to purchase your first home, you will need to check your super fund allows FHSS contributions and, more importantly, withdrawals. You’ll then need to arrange for your employer to deduct voluntary contributions of up to $15,000 a year. When you want to access your money, you will have to acquire a ‘FHSS determination’ (essentially a balance statement) from the Commissioner of Taxation before requesting your super fund to release the money.

Following approval of this request, your super fund deposits your FHHS money, minus any tax you've incurred, into your account. You then have 12 months to sign a contract to buy or build a home.

If you are looking to downsize your home, you will first need to check your super fund accepts downsizer contributions. If it does, you can deposit up to $300,000 within 90 days of receiving the proceeds of the sale. You’ll have to fill in and send your super fund a ‘downsizer contribution form’ before, or when transferring the money into your account.

If you’re hoping to either buy your first home or downsize, call us to discuss how the changes to super can save you money.

Weighing up the value of life insurance

It probably comes as no surprise to anyone that there is a significant underinsurance gap between what we would need to maintain our standard of living should the unthinkable happen, and what we are actually covered for in the way of insurance.

Australia is one of the most underinsured nations in the developed world, ranking 16th for life insurance coverage.

There are lots of reasons people give for not buying life insurance, but top of the list is invariably cost. Sounds reasonable enough, especially when households are under pressure from increasing costs of living. But dig a little deeper and it turns out the way we weigh up decisions when outcomes are uncertain is not always in our best interests.

According to something called ‘Prospect Theory’, people fear a certain loss more than they value a larger but uncertain gain. We tend to view money spent on insurance premiums as a loss, unlike money spent on a daily cup of coffee, a pair of shoes or a weekend away, which deliver immediate rewards.

There’s also a disconnect between what we say we value and what we spend our money on.

Thinking about the unthinkable

When asked, most people say the thing they value most is family. Yet when it comes to insurance many of us cover our car and our home but overlook our most important assets - our life, our ability to earn an income and the wellbeing of the people who depend on us.

Thinking about being diagnosed with a terminal disease, suffering a disabling accident or contemplating your own death or that of your partner is uncomfortable. Seeking cover for those possible eventualities is something that is very easy to put off or avoid altogether.

The real value of life insurance is the peace of mind, that if we die or become seriously ill and are unable to work then the right amount of money will go to the right people when they need it most.

Types of life insurance

There are three main types of life insurance. Death cover provides a lump sum if you die or are diagnosed with a terminal illness; total and permanent disability (TPD) pays a lump sum if you are permanently disabled due to an accident or illness and unable to work; and income protection provides a monthly payment if you can’t work due to illness or injury.

The amount of life insurance you need depends on your family circumstances, your income and lifestyle. While many working Australians have default cover in their super fund, that’s no cause for complacency. It’s often a basic level of cover, which may need to be topped up outside super.

Take Chris, aged 30. He has a partner, two children and the median level of default life insurance cover in super for someone his age. That is, $211,000 in death cover, $162,500 for TPD and $2,250 a month for income protection. According to a recent report by Rice Warner, the amount someone in Chris’s position needs is closer to $704,000 of death cover, $910,000 of TPD cover and $4,150 a month of income protection.

Paying for peace of mind

Paying life insurance premiums won’t provide the instant pleasure hit of an espresso, but most people would be surprised to know that the peace of mind that comes from protecting their family’s financial security costs less than their daily cup of coffee.

Rice Warner estimates the cost of death cover and TPD cover for the average working Australian at less than 1 per cent of salary, and less than 0.5 per cent for white collar workers. iii Which begs the question, what cost do you put on the wellbeing of the people you love most?

If you would like us to help you work out the appropriate level of life insurance for your family, and the best way to achieve it, give us a call.

How Blockchain is already changing your world

Although we are only at the tip of the iceberg of blockchain’s immense potential, industry leaders like Bob Greifeld, CEO of Nasdaq, have already pegged the emerging technology as “the biggest opportunity set we can think of over the next decade”. i From the humble origins of Bitcoin, blockchain has since captured the imagination of everyone from Richard Branson to Bill Gates and virtually every large financial institution on the planet.

Its purpose? To maintain the truest representation of data and transactions throughout the world, by minimising fraud, human error and even system failure. And that’s without mentioning the financial benefits – for example an estimated $6bn per year is anticipated to be made in global savings by streamlining the clearing and settlement of transactions.

Blockchain is changing the way business is done all around the world, both for transactions as well as data processing where accuracy and security is paramount. If that sounds broad, that’s because it is: more and more applications for the technology are being discovered as it evolves.

Wait, what is blockchain?

A blockchain (singular) is a digital ledger that’s shared between many parties. Kind of like a database or a spreadsheet that everyone can see and update – but not edit or delete. When a transaction is completed, it becomes a block in the chain. The way it works means no one party has control; it’s decentralised. Each block in the chain contains a re-coded copy of part of the last block. It’s also easy to verify information or transactions, because each block in the chain comes with its own little timestamp.

This makes it suitable for a variety of commercial and practical purposes. Where once ledgers or transaction histories were proprietary, they’re now public (at least to the extent they need to be – there’s still privacy and personal secrecy at the individual’s entry point to the blockchain network). To contrast it with ‘traditional’ digital transactions, it’s viewable and verifiable by everyone (not just the two parties to the deal), and the record can’t be changed or deleted. If a transaction has to be corrected, the difference or reversion is worked out and another block is created.

What's blockchain being used for right now?

Around the world, several private companies are working on ways to use blockchain for medical records. iii The advantage would be that it would be accessible from anywhere, any time, reducing guesswork and errors in critical situations. At the moment, different digital medical record systems are all in different ‘languages’, and privacy laws mean it’s hard to share a physical paper file. If you’re thinking, “hold up, wouldn’t that mean everyone would be able to see my private health information?!” don’t worry – each block is coded and can only be ‘opened’ with a private key. So, for example, you might have to give your doctor a password to access your info.

Close to home, Australian environmental advocates have recently piloted a project to track tuna from where it’s caught, right to the end consumer. It’s being done by the WWF in conjunction with a fishing company and a tech company. The idea is that instead of fishing boats being able to fudge records, or third party monitoring bodies being vulnerable to corruption, each stakeholder verifies their point in the process in real time. And it’s as simple as using smart phones to capture the proof.

What's next?

The thing that’s got the business world so hyped about blockchain is that it’s got almost endless applications where transactions need to be secure and records unchangeable. There’s no doubt that blockchain will ruffle the feathers of businesses whose main value proposition is that they’re the sole repository for critical data. In the next few years, massive institutions like payment networks could disappear. And the international politics of regulating a decentralised system are going to be… intense, to say the least.

We’re teetering on the precipice of a massive change in the way we communicate security-sensitive information. It’ll be exciting to see where blockchain takes us next.

Home

Financial Planning | Latest News

ByWSCADMIN Created on March 30, 2017

Response to Market Volatility

We are currently witnessing increased volatility in financial markets. Market declines spook people and many think the worst. Financial media quickly switches into alert mode by showing special segments and pumping out more reports, while anyone pushing a newsletter proclaiming the end is near jumps in to proclaim “this is the moment!”

Despite all the extra attention and analysis, there’s little sense to be made from what you’ll see, read or hear because most of it is hot air and not worth your consideration.

When these confronting market movements are in your face there’s nowhere to hide from the attention they’ll get, yet financial markets will soon be ignored again, until the next blow up occurs.

To understand the scope of attention a market decline will get, consider this: the media never dedicates a front page and pages 4 and 5 to the sharemarket when it goes up 3-4% - only when it’s down. The sharemarket never leads the nightly news when it’s had a great day – only when it’s had a terrible day.

It’s also worth widening your view to include recent years. These market behaviours aren’t anything new. In the five years across 2010-2014 there were nine corrections of 5% or more and another that was 15%. The last whopper was in 2011, that was over 20% and as a result of the US debt ceiling crisis.

So there have been eleven corrections since 2010, excluding the goings on of this year. Each time someone has proclaimed it to be the beginning of the end, but life went on and markets continued to trade up, down and sideways – as they always do.

Some key things to always remember.

Financial markets aren’t a scare free ride. We expect higher returns from shares because of the exact volatility we’re seeing. Share markets move fast in both directions and to capture the upside you’ll inevitably capture some of the down.

Market timing is no solution. It would be fantastic to eliminate the downsides and only ride the markets upward, but no one has ever consistently been able to do this. Take those eleven corrections we mentioned, no one predicted their beginning and no one predicted their end. The smart investors don’t pretend they know what will happen next.

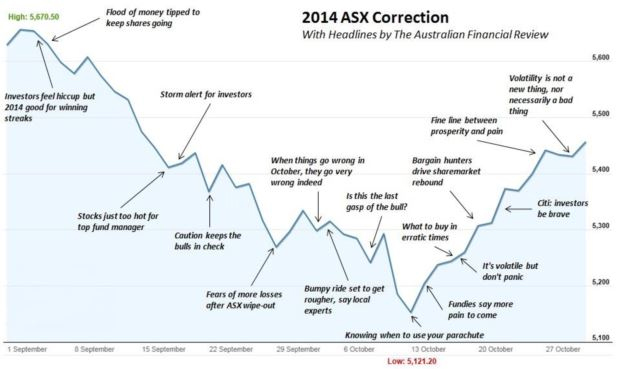

As an example, here’s a chart of last year’s correction with media headlines superimposed. Notice the tip that money would continue to flood into shares just as the market started to fall and then the call to grab your parachute and jump just as the market bottomed! This is the exact reason the media is a poor investment adviser.

Diversification is imperative. A mix of different assets comprising the defensive (bonds & cash) and the more volatile (shares and listed real estate), spread across the world, will inevitably provide a more stable portfolio than one wholly ignoring the defensive/global aspect. Different asset classes often act in different ways and offset moves of the other. As an example, bonds have been positive recently as shares have performed poorly, while listed real estate has remained somewhat stable.

The important thing in times like this is to stay calm. Sure, there has been pain, but part of investing is learning to handle that pain. As we’ve shown by the number of corrections over the past 5 years this isn’t a new phenomenon, but as history has shown, over the longer term we should be rewarded for our patience and discipline.

As always, if you would like to discuss this or any other item, please don’t hesitate to call us.

Kind regards,

Matthew Laird

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.