October 2025

Economic and Market Overview

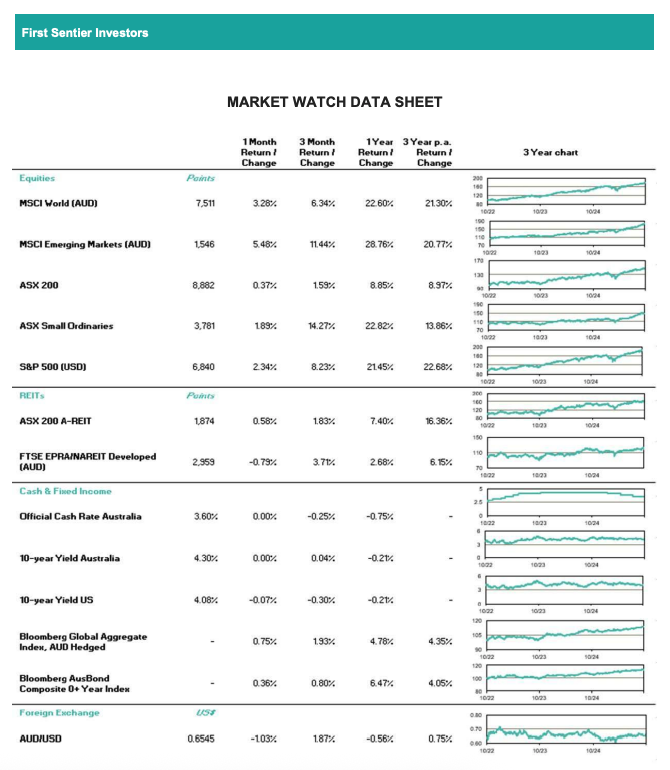

- Global: Trade tensions re-escalated in October, with the US responding to increased rare earth export controls from China with an additional 100% tariff alongside export controls on critical software. This led to the S&P500 experiencing its largest one-day decline since Liberation Day in April, falling by -2.71% on October 10 in the wake of the announcements.

- Gold prices accelerated to fresh record highs in the middle of the month amid global trade tensions, the continued US government shutdown and expectations of further Fed cuts. The yellow metal then pared gains in the second half of the month as trade tensions eased and investors took profit, with the spot gold price ending the month +3.7% higher at US$4002.92/oz.

- By the end of the month, US President Donald Trump and China's President Xi Jinping met to discuss a potential deal, during which Trump reduced the fentanyl tariff on China by 10%, while China agreed to pause export controls on rare earths.

- Global equity indices continued to create fresh highs throughout the month amid robust corporate earnings and continued monetary policy easing from global central banks. The MSCI World Index advanced +1.9%, with a strong contribution from US equities. The S&P500 added +2.3%, the Dow Jones gained +2.5% and the tech-heavy NASDAQ rallied +4.7%. European equities also fared well, with the Stoxx600 gaining +2.5% on the month and the FTSE100 adding +1.9%.

The global services PMI declined to 52.8 in September, from 53.4. The global manufacturing PMI ticked lower to 50.8, from 50.9.

US: The US federal government entered a shutdown on 1 October, resulting in delayed economic data prints and missed pay checks for furloughed employee. Treasury yields rallied on the risk off sentiment and as markets fully priced in a 25bp cut at the October Fed meeting.

- Nvidia became the first stock to reach a US$5tn market cap, amid a broader AI rally. Major US stock indices continued to reset their record highs throughout the month amid corporate quarterly earnings and increased AI-related spend. NASDAQ +4.7%, DOW +2.5%, S&P500 +2.3%.

- Fed Chair Jerome Powell indicated in a speech mid-month that the Fed was on track to deliver a 25bp rate cut at its end of October meeting, despite the lack of economic data, as the economic outlook appeared unchanged since the Fed last met.

- Core CPI surprised to the downside in September, rising +0.23% MoM vs consensus +0.3% MoM.

- At the end of the month the Fed delivered the widely expected 25bp rate cut, however Fed Chair Powell advised that a further rate cut in December was not a "foregone conclusion". Prior to this statement, the market had fully priced in a 25bp cut in December, with Powell's commentary sparking a repricing in the market. By the end of October, this had fallen to 67% priced in.

The DXY appreciated +2.1% during October amid the more cautious outlook towards future rate cuts from the Fed.

Australia: The ASX200 traded +0.4% higher in October, reaching a fresh high at 9,108.6. AGMs and a mixed bag of trading updates captured investor attention through the month.

- The monthly household spending indicator slowed to +0.1% in August, below consensus expectations of +0.3%.

- The unemployment rate rose unexpectedly to 4.5%, from 4.3% in September, the highest level of unemployment since November 2021. This saw money markets begin to price in the likelihood of a rate cut in November.

- RBA Governor Bullock provided hawkish commentary towards the end of the month at an industry dinner, during which she advised that the labour market remained tight, with upside risks to the RBA's expectations for Q3 trimmed mean CPI. Consequently, the chance of a November cut was largely priced out again.

- Q3 CPI came in higher than expected, up +1.3% during the quarter, boosting the annual CPI increase from +2.1% to +3.1%. This caused markets to almost entirely price out the chance of a further rate cut in 2025. Interest rate sensitive stocks, including REITS and tech companies, sold off as the likelihood of further rate cuts diminished.

The Aussie Dollar experienced a U-shaped month against the USD, ending October -1.0% lower. The AUD sold off on the unemployment print, and then appreciated as the market began to price out the likelihood of imminent future rate cuts.

New Zealand: The RBNZ delivered a unanimous 50bp rate cut in its October meeting to 2.5%. The market had priced a ~50% chance of a 50bp rate cut at this meeting. A further 25bp rate cut in November is almost fully priced in.

Q3 CPI increased by +1.0%, slightly higher than market expectations for +0.9% and bringing yearly CPI to +3.0%, from +2.7% previously.

Europe: The FTSE100 and STOXX600 both reset their record highs during the month, advancing +3.9% and +2.5% respectively, for the most part tracking gains from its US peers.

- Eurozone inflation ticked higher in September in line with consensus, up to +2.2% YoY from +2.0% YoY previously.

- European Union countries turned in their 2026 general government budgets to the EU Commission during October. Germany's budget showed front-loaded fiscal expenditure growth, with its general government deficit widening to 4.75% of GDP in 2026 and 4.25% in 2027. Conversely, Italy's budget saw a continuation of moderate fiscal conservativism.

- S&P downgraded France's sovereign credit rating in an unscheduled decision, to A+ from AA-. The ratings agency highlighted risks to the French government (present or future) being able to see through fiscal consolidation.

- The European Central Bank kept rates on hold at 2% as widely expected, reiterating that the policy rate was in a "good place".

The Euro depreciated -1.7% against the US Dollar during October, partially due to ongoing political uncertainty in France. The Euro closed the month at 1.1534 USD, its lowest point during the month.

China: Policymakers at the Fourth Plenum remained committed to the 2025 Objectives, which included modern industrial system and tech self-sufficiency.

- Q3 GDP growth slowed to 4.8% YoY, slightly above market expectations for 4.7% YoY. This was the lowest GDP growth reading in four quarters; however, the slowdown was likely expected due to softer monthly indicators released throughout the summer.

- The effective tariff rate on China from the US fell by 10% after the fentanyl tariff was reduced as a result of President Jinping's meeting with US President Trump in South Korea.

Australian dollar

- After posting a +1.1% gain against the USD in September, the AUD ended October at 0.6545, losing -1% over the month. AUDUSD traded a 177-pip range, opening around the month's high of 0.6623, and touching a low of 0.6446 mid-month.

- AUD declined into mid-month as risk sentiment softened amid thin liquidity and a brief stall in the US equity rally. The USD index had one of its best weeks YTD which saw AUD fall to its lowest level in two months.

- Focus then turned to AU Q3 Inflation on October 29. The metrics that the RBA typically focuses on were stronger than expected, including details around shelter costs, domestic services and market-based prices. Following this, the market began to price out the chance of a further rate cut in 2025 from the RBA. On the pick-up in AU rate expectations, AUD climbed to a high of 0.6618 post CPI print. It settled around 0.6550, before closing the month slightly lower at 0.6545.

Australian equities

- The ASX200 gained +0.4% during the month, resetting its intraday record high mid-month at 9108.6. AGMs and trading updates were the focus of the month, as investors looked for indications on how FY26 has commenced.

- Materials led the index, up +4.3%, led by lithium stocks as they tracked gains in the underlying commodity price and headlines that China intends to impose export controls on advanced lithium batteries. PLS +31.0%, LTR +19.3%.

- James Hardie traded +14.7% higher on the month after reporting its preliminary Q2 results ~67% ahead of previous guidance at the midpoint due to improved performance in its Siding & Trim business. At the end of the month at the AGM, the Chair was voted off the board, alongside two other directors.

- Tech stocks underperformed the index, down -8.4% on the month. Of the group's constituents, WTC saw the largest percentage decline, down -23.4% after reporting that officers from ASIC and the AFP executed a search warrant regarding alleged trading in WTC shares from Richard White and three other WiseTech employees. WTC advised that it was unaware of any charges laid against the company or any employee.

- The Consumer Staples sector ended the month near flat with the major supermarkets seeing divergent share price performance; WOW +6.4%, COL -5.3%. While WOW reported softer than expected Q1 earnings, the company provided a Q2 trading update which suggested AU Food sales growth had risen +3.2% MTD in October, outpacing market forecasts for the full quarter. COL reported in line Q1 earnings a day later, with momentum continuing into Q2.

- Health Care stocks declined -4.8% in October, with sector heavyweight CSL down -9.9% on the month. CSL fell after downgrading its FY26 NPATA growth outlook at its AGM by 3% at the midpoint. It also advised that it had pushed out the timeline for the demerger of Seqirus, its flu vaccine business.

Global equities

- Global equities traded higher during October, with many global indices resetting their record highs during the month driven by quarterly corporate earnings. The MSCI World Index gained +1.9%.

- US indices NASDAQ +4.7%, DOW +2.5%, S&P500 +2.3% reset highs on positive earnings from major banks and mega cap tech companies.

- Tech stocks led the S&P500, with the sector gauge up +6.2%. Nvidia gained +8.5% on headlines throughout the month that it will invest US$100bn into OpenAI and that it will build seven supercomputers for the US Department of Defence.

- Alphabet gained +15.7% during October, seeing gains after reporting Q3 Search and Cloud revenue ahead of expectations, driven by strong AI demand. Amazon advanced +11.2% after reporting better than expected Q3 results and Q4 guidance, due to AWS revenue accelerating to +20% YoY and adding 3.8GW of new capacity.

- In Europe, the STOXX600 gained +2.5%, while the FTSE100 advanced +3.9%. Both reset their record highs during October.

- In Asia, the MSCI Asia Pacific Index increased +3.6%, boosted by gains in Japan (+16.6%) and Korea (+19.9%).

Property securities

- Global property securities fell slightly in October down -1.5% in USD terms after a strong ~12% return to September YTD. The movements reflected renewed trade war concerns along with persistent concerns about inflation and higher interest rates. The weaker October result followed two consecutive months of positive returns in September (+1.2%) and August (+4.5%).

- The Americas region performed in-line with Global being down -1.6% in October driven by US China trade war escalation. The negative month follows 2 consecutive months of positive returns with 1.3% in September and a strong >4% return month in August. The Americas region REITs are now up ~4% YTD.

- Europe/UK returns outperformed global average in October but were down -0.6% following +0.4% returns in September and +1% in August. However, Europe/UK has performed strongly YTD with ~18% total return.

- The Asia Pacific region returns underperformed global averages with -2% returns in October on trade war concerns. The key driver was weaker returns in China/HK. This is a change in trend with positive returns seen in APAC region since April. as inflation cools across the region. However, APAC region has outperformed YTD with ~20% returns.

- Locally, AREITs were down -3% this month, a continuation of the weaker -3% from September which was a turn from the positive returns consistently since April. The weaker performance was primarily driven by higher CPI and resulting in a November rate cut no longer being expected by consensus as well as potential for lower rate cuts this cycle. YTD, AREITs are up ~6%.

Fixed income and credit

- October 1 marked the beginning of the US government shutdown and as such, most tier 1 data was not released, including non-farm payrolls for September. This saw Treasuries rally as markets moved risk off, and curves steepen as market pricing rallied to price in a 100% chance of a Fed cut in the October meeting.

- Over the month, Treasuries grinded lower, with the US 10yr Treasury yield closed the month -7.3bps lower at 4.078%.

- AU swap spreads were the domestic topic of the month, as the 10yr point grinded wider from approximately -8bps to +0.875bps at month-end.

- This move became a US story after Fed Chair Powell made comments on ending QT in the coming months in mid-October. This was a catalyst to see US invoice spreads push wider and add to the sharp widening domestically in Aussie swap spreads.

- AU swap spread widening was further supported as the Fed announced a proposal to see smaller capital hikes for big banks a week later, exacerbating the move in both US and AU swap spreads, due to the beta of AU spreads to their US counterpart.

- Credit spreads widened mid-month on concerns regarding the health of the global credit market amid the collapse of several small lenders in the US. Spreads tightened again towards the end of the month on strong corporate earnings and advancing equity markets.

- US investment grade credit spreads finished the month mostly unchanged, despite a volatile month, where spreads widened in the first half of October, before tightening towards month-end. High yield spreads followed a similar trend, however finished the month +6.7bps wider.

Important information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should consider, with the assistance of a financial advisor, your individual investment needs, objectives and financial situation.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

About First Sentier Investors

References to 'we', 'us' or 'our' are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Certain of our investment teams operate under the trading names AlbaCore Capital Group, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners, all of which are part of the First Sentier Investors group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311).

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson's Quay, Dublin 2, Ireland; reg company no. 629188).

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB).

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167)

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested

© First Sentier Investors Group

IMPORTANT INFORMATION

This document has been prepared by Count Limited (Count) ABN 11 126 990 832. While care has been taken in the preparation of this market update, no liability is accepted by Count, its related entities, agents and employees for any loss arising from reliance on this market update. Count advisers are authorised representatives of Count.