October 2024

Economic and Market Overview

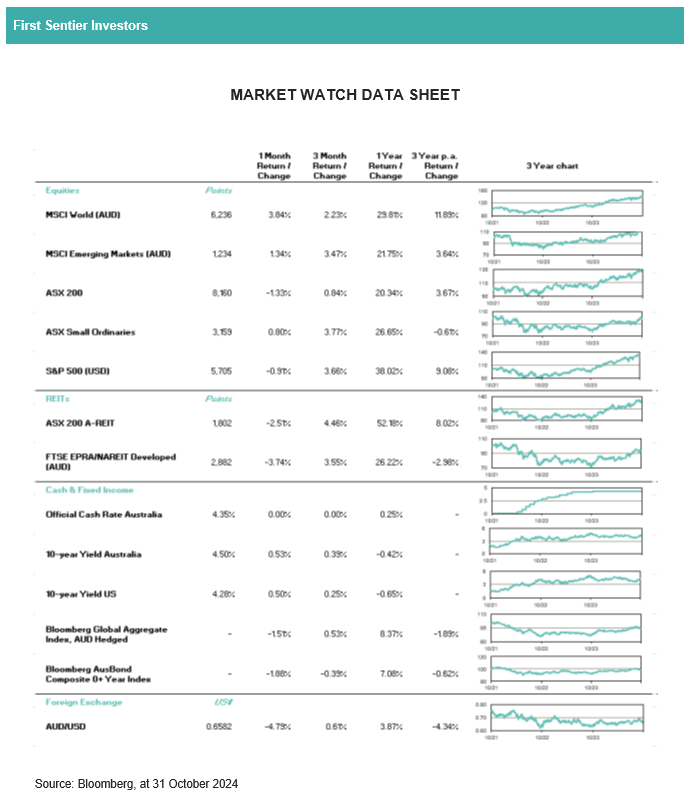

- Investors maintained a healthy risk appetite for much of the month, which enabled major share markets to make further progress. Movements in the US set the tone, with the S&P 500 Index rising to fresh all-time highs during the month.

- Towards month end, however, subdued results from some of the largest technology firms in the US saw markets reverse direction and close the month slightly lower.

- Returns from bond markets were also negative.

- Despite a 0.50% cut to the Federal Funds rate in September, investors remain concerned that inflation could creep higher – especially if either Trump or Harris pursue expansionary fiscal policies after becoming President in early November.

- Treasury yields rose sharply – dragging bond valuations lower – as some of the interest rate cuts anticipated in the US for 2025 were removed from consensus forecasts.

- There is scope for some market volatility in the US in the near term if the election is close and one of the candidates challenges the result. The outcome is likely to depend on voting in seven ‘swing’ States – Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin – each of which have the potential to determine the result.

- Opinion polls suggest the result is on a knife edge, opening up the possibility of recounts in some States, or even potential litigation as we saw in the weeks following the 2021 election.

Either way, fundamentals should have reasserted themselves as the main drivers of financial markets by January at the latest.

US: Initial estimates suggested the US economy grew at an annual rate of 2.8% in Q3. This was marginally below expectations and was a slowdown from Q2, but nonetheless highlighted the resilience of the economy.

- Growth was supported by strong consumer spending, with encouraging demand for both goods and services.

- It seems discretionary expenditure was underpinned by a buoyant labour market and the associated impact on consumer confidence. Payrolls data showed that more than 250,000 jobs were created in September, which was more than 100,000 ahead of forecasts.

- Employment growth in October – released at the beginning of November – was much less strong. The labour market will therefore remain very closely monitored in the months ahead, as investors try and work out the likely interest rate path.

For now, inflationary trends seem quite persistent. The Core PCE measure showed consumer prices still rising at an annual rate of 2.7% in September, which makes it less certain that policymakers will lower interest rates aggressively in the near term. Rate cuts are still anticipated both this year and next, but consensus forecasts now indicate official borrowing costs will settle around 3.5% by the end of 2025, rather than 3.0% that was anticipated at the beginning of October.

Australia: No formal Reserve Bank of Australia meetings were scheduled in October and so official interest rates were unchanged at 4.35% during the month.

- Policymakers will meet twice more before the end of this year, however, and continue to monitor incoming economic data to gauge whether changes in monetary policy settings are warranted.

- The ‘trimmed mean’ measure of inflation showed consumer prices rising at an annual rate of 3.5% in Q3. This was down slightly from the prior quarter, but was still above the Reserve Bank of Australia’s 2% to 3% target range.

- With inflation still running above target and given ongoing strength in the labour market, few observers are expecting interest rates to be lowered any time soon.

- Australian unemployment remained at 4.1% in September and more than 60,000 jobs were created over the month. New job adverts also increased, suggesting the unemployment rate could remain low for the foreseeable future, in turn exerting upward pressure on wages.

Against this background, policymakers might even consider raising borrowing costs further, rather than lowering them as many homeowners and businesses are hoping.

New Zealand: Interest rates were lowered by 0.50% at the Reserve Bank of New Zealand’s October meeting, following an initial 0.25% cut in August.

- The annual inflation rate fell to 2.2% in Q3, down from 3.3% in Q2 and 4.0% in Q1, highlighting the extent of the moderation in pricing pressures.

There appears to be excess capacity in the New Zealand economy following a recent slowdown, increasing the case for lower borrowing costs.

Europe: At 0.9% year-on-year, GDP growth in the Eurozone came in higher-than-expected in Q3. The acceleration from Q2 was supported by another strong contribution from Spain, although growth in Germany and France – the two largest economies in the Eurozone – was also above expectations.

- The Olympic Games provided a boost in France, while there was an encouraging improvement in activity levels in Germany.

- Recent commentary from European Central Bank officials suggests policymakers are increasingly confident they are winning the fight against inflation. In turn, interest rates were lowered by 0.25% during the month; the third cut in the past five months. More importantly, it seems almost certain that borrowing costs in the Eurozone will be lowered further in the months ahead.

- The release of the new Labour government’s first Budget was the main focus in the UK.

As anticipated, the Chancellor outlined plans to raise an additional GBP40 billion through taxation in order to improve the country’s budget deficit.

Asia: Interest rates were lowered in China, as officials in Beijing tried to boost borrowing and investment. The one-year loan prime rate – used as a reference for consumer and business lending – was cut by a further 0.25%, following an earlier 0.10% cut in July.

- Separately, there was an unexpected improvement in Chinese manufacturing data following five months of deterioration. This raised hopes that recent stimulus measures may be feeding through to the real economy.

- The increase in factory output also supported a steady improvement in business confidence, which augurs well for investment.

- In Japan, the latest commentary from central bank policymakers suggested the Bank of Japan will continue to rise interest rates if the inflation target is met.

- Officials are expecting 2.5% inflation for the 2024 year, and annual GDP growth of 0.6%.

Australian Dollar

- The revised outlook for US interest rates meant the US dollar fared very well. The greenback enjoyed its strongest month of performance in two years and appreciated against almost all major currencies worldwide, including the Australian dollar.

- The AUD depreciated by around 5% against the US dollar over the month.

- This move lifted returns from overseas assets for local investors. While returns from global shares were negative in local currency terms, for example, they added value in AUD terms owing to currency market movements.

Australian Equities

- Australian shares lost ground in October, following five consecutive months of gains. Volatility in commodity prices, owing to ongoing geopolitical tension in the Middle East, and mixed economic data from China dampened sentiment.

- Company news flow from AGMs, trading updates, and other announcements also caused some meaningful share price reactions during the month, b

- oth positively and negatively.

- Overall, the S&P ASX 200 Accumulation finished the month 1.3% lower.

- All constituents in the Utilities sector closed the month lower, dragging the sector down 7.2%. AGL Energy and APA Group fared the worst in this area of the market, falling between 10% and 12%.

- The Consumer Staples sector (-7.0%) also lagged, with negative sentiment continuing to stem from the ongoing regulatory investigation into supermarket operators.

- Metcash (-14.5%) was among the worst performers, with the business communicating weaker trading conditions impacting its Hardware business. Woolworths’ 1Q25 trading update also disappointed investors, with earnings guidance falling short of investor expectations. Margins came under pressure during the quarter as customers became increasingly value-conscious and pushed the shares down 10.0%.

- More positively, all of the ‘big four’ banks made positive progress, adding between 1% and 6%, which helped the Financials sector add 3.3%. Company-specific news supported gains in other Financials stocks including HMC Capital (+24.0%) and HUB24 (+18.4%). The latter pleased investors with a trading update that highlighted an 8% increase in its Platform funds under administration over the quarter, driven by record net inflows of $4 billion.

- Gains in the Health Care sector were also attributed to company-specific factors. Sigma Healthcare, for example, added more than 35% after suggesting it is willing to make concessions that could alleviate regulatory concerns over its proposed acquisition of Chemist Warehouse. The sector closed the month 1.0% higher.

- Small caps outperformed their larger cap peers, with the Small Ordinaries Index adding 0.8%.

- Selected Small Materials stocks fared well, with solid contributions from gold miners as the gold price continued to trend higher. Arcadium Lithium was another standout performer, almost doubling in value after receiving a takeover offer from Rio Tinto.

Global Equities

- Many of the largest listed companies in the US and Europe announced their earnings for the three months ending 30 September.

- The tone of these releases was generally positive for much of the month, which translated into steady gains in major markets. In the US, the S&P 500 Index rose to fresh all-time highs in mid-month, for example.

- Several of the ‘Magnificent Seven’ technology-related stocks announced their earnings in the last week of the month. Underwhelming results from companies including Microsoft and Meta weighed on sentiment towards month end.

- As a result, the US share market gave back its earlier gains and closed the month slightly below its end-September level. The S&P 500 Index closed October down 1.0%, while the tech-heavy NASDAQ also closed slightly lower. That said, both indices are still up more than 20% in the calendar year to date.

- In Europe, major bourses including Germany and France lost ground despite the improvement in GDP growth data. The FTSE 100 Index in the UK also drifted lower.

- In Asia, the performance of Japanese shares was a highlight. In fact, the Nikkei was the only major global share index to make positive progress over the month.

- Elsewhere in the region, shares in China and Hong Kong closed lower, giving back some of September’s exceptional gains.

Property Securities

- Exchange rate movements meant global property securities added value in October for AUD-denominated investors. The FTSE EPRA/NAREIT Developed Index retreated in local currency terms – with all international property markets closing the month lower – but added 0.6% in AUD terms.

- Macroeconomic uncertainty weighed on sentiment during the month, with persistent inflation, the upcoming US election, and the announcement of a new budget in the UK all affecting investor confidence.

- Japan (-1.5%) was the best performing market, although it still lost ground. The yen weakened by around 6% against the US dollar over the month and the Liberal Democratic Party lost its parliamentary majority following a snap election.

- Other outperforming countries in local currency terms included Australia (-2.6%) and the US (-2.9%).

- Laggards included Sweden (-11.1%) and Spain (-9.3%). Generally speaking, persistent inflation in Europe hampered local property stocks. Investors became less confident that interest rates will be lowered significantly in the near term, which weighed on interest-rate sensitive property sectors in the region.

Fixed Income and Credit

- Both Trump and Harris are expected to boost government spending if elected as US President, which could see inflation gather pace – particularly at a time when the Federal Reserve is lowering official interest rates.

- Yields on Treasuries rose sharply over the month against this background. The yield on benchmark 10-year securities soared around 0.50%, for example.

- The change in sentiment and the extent of the movement in yields resulted in unfavourable returns from global fixed income.

- Yields in other major sovereign bond markets rose too.

- UK gilt yields moved higher following the release of the Budget. Existing debt rules were amended, opening the door for a meaningful increase in gilt issuance in the years ahead. Other things being equal, a significant increase in supply is expected to result in lower prices and higher yields over time.

- Yields on German and Japanese government bonds also rose, albeit by less than comparable securities in the US and UK.

- Locally, yields on Australian Commonwealth Government Bonds rose sharply. Like in the US, yields on 10-year securities closed the month around 0.50% higher.

- The moderation in inflation in Q3 is not expected to be sufficient to prompt the Reserve Bank of Australia to lower official cash rates at its meeting on Melbourne Cup day.

- Credit spreads tightened to three-year lows, reflecting the broad ‘risk on’ sentiment that was evident for much of the month and the generally pleasing earnings releases from listed companies.

- Default risk appears contained, making the additional prospective yields from credit securities attractive for income-seeking investors, in particular.

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should consider, with the assistance of a financial advisor, your individual investment needs, objectives and financial situation.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

About First Sentier InvestorsReferences to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners, all of which are part of the First Sentier Investors group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311).

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188).

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers, Stewart Investors, Realindex Investments and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), Realindex Investments (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

- Japan by First Sentier Investors (Japan) Limited, authorised and regulated by the Financial Service Agency (Director of Kanto Local Finance Bureau (Registered Financial Institutions) No.2611).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB).

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group