June 2025

Economic and Market Overview

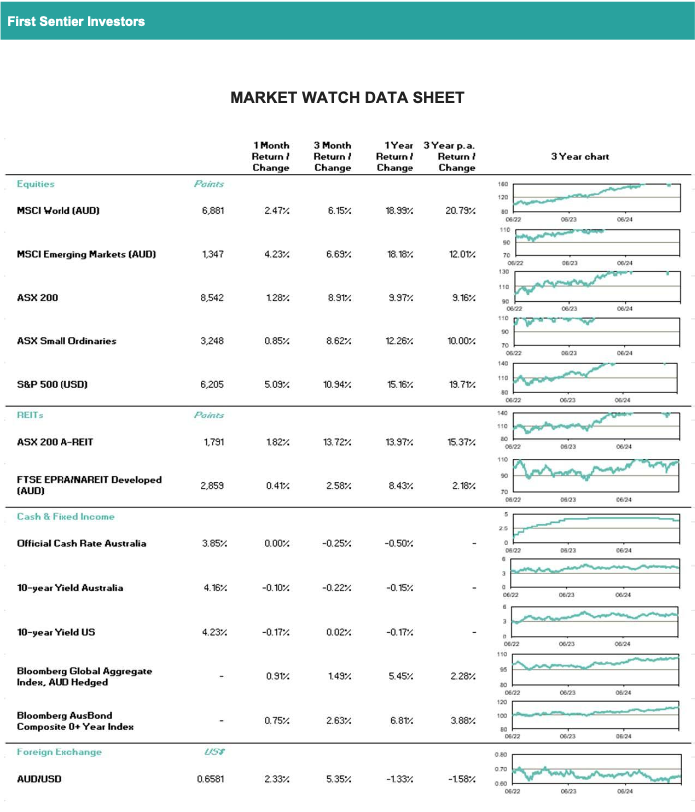

- Global: Geopolitical tensions remained in focus in June as renewed conflict in the Middle East disrupted oil supply routes and raised concerns about broader regional instability. Oil prices spiked as tensions rose and supply concerns mounted, though moderated after a ceasefire was called 12 days later. Brent closed June +5.8% higher at $67.61.

- Gold reached near two-month highs amid the Middle East tensions as investors looked to rotate back into safe haven assets. Subsequently, and similar to the price action seen in oil, gold retreated after the ceasefire was called, ending the month up just +42bps at US$3,303/oz.

- Uncertainty around US-China trade relations also persisted following fresh export controls and retaliatory rhetoric from both countries. However, at the end of the month, the two nations reached a framework agreement involving a mutual easing of export controls and temporary tariff rollbacks.

- Despite increased uncertainty arising from conflict in the Middle East and broader geopolitical relations, equity markets around the world notched new record highs. The ASX200, S&P500 and Nasdaq indices all reset their record highs throughout June. The MSCI World Index also closed the month at a record high, having advanced +4.2% over the course of June.

The global manufacturing PMI declined from 49.8 to 49.6 in May, driven by declines in China and Poland. Global services PMI increased to 52.0, as several developed market economies saw improvement.

US: Both the Nasdaq and S&P500 indices closed at record highs on June 30, following a volatile trading month. The S&P500 gained +5.0% throughout June, while the Nasdaq advanced +6.6%.

- The Fed kept interest rates unchanged during June at 4.25%-4.5%. Fed Chair Jerome Powell advised that the Fed will likely watch labour market and inflation data “over the summer” before making policy rate changes. The market has priced in two further rate cuts before the end of 2025.

- The DXY declined -2.5% throughout June, after trending down for the majority of the month.

- 10yr US Treasury yields declined in the back half of the month, down -3.9% in June to 4.230%. The 2yr US Treasury yield followed the same trend, declining -4.6% to 3.721%.

- Core PCE inflation increased +0.179% MoM in May, slightly stronger than consensus estimates of +0.14% MoM.

- The unemployment rate remained unchanged at 4.2% during May, with the US economy adding +139k new jobs, slightly stronger than the expected +126k. Job growth was heavily concentrated in leisure, hospitality and healthcare. Household employment declined by -696k.

- Total retail sales declined by -0.9% MoM in May. April total sales was also revised lower. The largest drag on May numbers was from auto sales, which declined -3.9% MoM.

Industrial production fell by -0.2% MoM in May, slightly softer than flat consensus expectations.

Australia: The ASX200 reset its intraday record high during June at 8639.10. It ended the month at 8542.27, up 1.3% on the month.

- The Fair Work Commission awarded a 3.5% increase to minimum wage, implying a 1% real wage increase.

- Q1 GDP printed at +0.2%, weaker than the implied RBA path of +0.4%.

- CBA became the first ASX-listed company to reach a market capitalisation of $300bn during June.

- The jobs market unexpectedly lost -2500 jobs, vs the +21.2k expectations. The unemployment rate held steady at 4.1% for the fifth consecutive month. The underemployment rate fell to 5.9% from 6.0%.

- The AUD gained +2.3% against the USD throughout June, ending the month at 0.6581, with some strengthening occurring mechanically due to weakening in the USD. This is the strongest the AUS has been against the greenback so far in 2025.

- Government bond yields fell throughout June, with the 10yr yield falling -2.3% to 4.152% and the 2yr yield declining -1.6% to 3.231%.

Consumer sentiment increased by 0.5 points to 92.6 in June.

New Zealand: Q1 2025 GDP increased by +0.8%, stronger than the expected +0.7%. The acceleration was driven by gains in manufacturing and business services. Household consumption expenditure increased by +1.4% in Q1, the largest quarterly gain in three years.

Europe: ATO countries agreed during the NATO summit in Hague to increase their defence spending to 5% of GDP annually over the next 10 years. This is a marked increase from the previously agreed 2% of GDP.

- The European Central Bank cut interest rates by 25bps to 2.0% as expected during June. The Bank of England left rates unchanged at 4.25%, as widely expected, while Norway’s Central Bank delivered a surprise 25bp rate cut, bringing its policy rate to 4.25%.

- The Euro strengthened +3.9% against the USD throughout June to 1.1792, its strongest level since 2021.

- The STOXX 600 declined throughout June, unlike its US and AU peers, falling -1.3%.

- Eurozone headline HICP eased more than expected in May, from 2.2% to 1.92% (vs 2.0% consensus). Core inflation surprised to the downside, easing to 2.3% (vs 2.5% expectations).

The Eurozone manufacturing PMI increased to 49.4 in May, up from 49.0 in April. Services PMI fell into contractionary territory, to a 16-month low of 48.9, compared to 50.1 in April.

China: China’s trade war with the US pivoted to rare earths export restrictions after global manufacturers raised concerns that the restrictions would impact production timelines. This was resolved towards the end of the month, with China agreeing to expedite rare earth shipments to the US.

- Exports grew by +4.8% YoY in May, on a higher base. Exports to the US declined, however exports to the rest of the world saw increases. Imports fell -3.8% YoY, below market expectations of -0.8% YoY.

- The PBOC kept policy rates unchanged in June as largely expected.

- May headline CPI remained unchanged at -0.1% YoY, the fourth consecutive negative print.

- Manufacturing PMIs increased to 49.7, slightly higher than expectations of 49.6. Non-manufacturing PMIs increased to 50.5, slightly higher than consensus 50.3.

Australian dollar

The AUD ended June +2.3% against the USD at 0.6581, seeing its fourth month of consecutive gains against the greenback.

AUD touched a low of 0.6373 on June 23 after news broke that the US bombed key nuclear sites in Iran.

- AUD at the highs of 0.6581 at month-end, as ceasefire seems to be holding which is underpinning risk assets.

- Local AU Macro Data: The jobs market unexpectedly lost -2.5k jobs in May, vs the expected +21.2k. Unemployment rate remained unchanged at 4.1%. May CPI came in slightly strong at 2.4% YoY, vs 2.3% consensus. Trimmed mean CPI came in at 2.8% YoY vs 2.7% prior. While the print is stronger than consensus, it should not change the narrative for the dovish RBA.

Australian equities

- ASX200 reset its intraday record high at 8639.10 during June. The index closed +1.3% higher than it began, at 8542.27.

- The financials complex added +4.3% over the course of June. Notably in June, CBA became the first Australian-listed company to reach a market cap of $300bn. The stock closed the month up +5.0% and has now rallied +46.6% over the past year. CBA is now one of the top 10 banks in the world by market cap.

- ZIP saw the highest percentage gain of the financials complex, ending the month +54.7% higher after upgrading its full year EBITDA guidance by 5% to at least $160m (from $153m).

- day of announcement and closed the month up +16.2%.

- The Energy sector saw the largest percentage gain on the index in June, gaining +9.05. Energy stocks were beneficiaries of increased oil prices following the conflict in the Middle East. Throughout the month, oil gained 5.8%, while WDS and STO advanced +7.4% and +16.2% respectively.

- Mid-month, Santos received an indicative, non-binding takeover proposal from a consortium led by XRG, a subsidiary of Abu Dhabi National Oil Company, and the Carlyle Group. The offer was made at $8.89 per share, representing a 28% premium to the prior closing share price. The stock gained +10.7% on the

- Uranium miners saw gains on the news that the Sprott Physical Uranium Trust (SPUT) intends to buy US $100m of uranium, through a financing deal with Cannacord Genuity. A day later this was increased to US $200m, further boosting the sector. PDN +29.3 %, BOE +17.6 %, DYL +24.2%.

- XRO announced its acquisition of US payments platform Melio towards the end of June for US$2.5bn. This included an A$1.85bn share placement at $176. The stock ended the month at $179.80, down -2.4% on the month.

- JHX ended June +17.7% higher after AZEK shareholders approved the proposed acquisition, enabling the company to move its primary listing to the US. Despite the strong month, the stock is down -12.5% since announcing the transaction.

- Materials underperformed the index throughout June, with the sector declining -3.1%. Gold miners saw some of the largest losses in the sector, despite gold prices posting a slight gain on the month. WAF -19.8%, EMR -17.5%, EVN -12.0%.

- The Consumer Staples sector declined -2.3% on the month, with TWE weighing on the sector (-7.5%). MTS rallied +15.7% after reporting FY25 full year results at the top end of guidance.

- Elsewhere, IEL fell -48% in one day, after the international education services company advised that it expected student placements to fall by up to 30% in FY25 due to increased global uncertainty. The stock saw the largest percentage loss on the index, ending the month -53.0% lower.

Global equities

- Global equities were a mixed bag in June, with US indices closing at record highs, while European equities declined. Asian equities broadly posted gains, albeit more modest than those seen in the US. The MSCI World Index finished the month at record highs, up +4.25 on the month.

- Towards the end of June, both the Nasdaq and S&P500 indices reset their record highs, shrugging off the uncertainty from earlier in the month. The NASDAQ and S&P ended June up +6.6% and +5.0% respectively.

- The tech sector saw the largest percentage increase on the S&P500, gaining +9.7%. This was led by gains in Oracle Corp, which advanced +32.1%. This followed strong Q4 results and the announcement of a new cloud services agreement which is expected to deliver more than US$30bn revenue from 2028.

- TSLA was the only Mag7 stock to see declines throughout the month, down -8.35. The remainder saw varying levels of gains: AAPL +2.2%, NVDA +16.9%, MSFT +8.1%, GOOGL +2.6%, META +14.0%, AMZN +7.0%.

- European equities declined -1.3% throughout June, as conflict in the Middle East dampened investor sentiment. The Energy sector outperformed the broader index, up +3.9%. Financials saw the largest decline, down -6.2%.

- The MSCI Asia Pacific index gained +4.1% during the month. Gains were broad-based, led by the KOSPI (+13.9%).

Property securities

- Global property securities saw a decent June with positive 1.3% returns, slightly better than May (~1%) and April (0.9%) and much better than a weaker March (-2.0%).

- The Americas region saw a better but still negative month in June (-0.5%) after a weak May (-4.6%) and April (-2.2%)/

- Europe/UK continued its stronger performance up +4.1% in June, after a strong May (+4.6%), and an extremely strong April (+10.3%) return, potentially reflecting investors looking for alternatives and cheaper valuations in UK/European REITs despite a resilient rental backdrop.

- The Asia Pacific region had a stronger month of returns (+4.0%) in June, relative to +1.0% in May, but similar to a strong performance in April, up 4.5%. Lower rates and limited growth downside expectations from tariffs were key contributors here.

- Locally, AREITs had a more modest month (+0.7%) after 2 strong months (May +5% and April +6%), with the market waiting for clarity on rate cuts as the sector has become more crowded in recent months.

Fixed income and credit

- Overall, a strong month for fixed income, spurred by ongoing growth concerns and a notable dovish pivot in key central bank messaging leading markets to price additional cuts into 2025.

- The US market is pricing 66 basis points of rate cuts in 2025, after the Fed kept interest rates unchanged.

- The US 10yr Treasuries yield ended June 17 basis points lower at 4.230%.

- The US 2yr Treasuries yield followed the same pattern, rallying 20 basis points throughout June to 3.721% after briefly breaking above 4% in the first half of the month.

- The 30yr UST yield rallied 15 basis points to 4.776% during June.

- The RBA minutes from the May meeting disclosed that the RBA considered a 50bp rate cut in May. The market has now nearly fully priced in a rate cut in July (23 basis points), and more than three rate cuts by the end of 2025 (82 basis points).

- The ECB cut rates by 25bps to 2.0% in June, with the market nearly fully priced in for one more 25bp rate cut in 2025.

- US investment grade credit spreads ended the month -5bps tighter. The high yield credit spread followed the same trend, finishing June -33bps tighter.

Important information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should consider, with the assistance of a financial advisor, your individual investment needs, objectives and financial situation.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Certain of our investment teams operate under the trading names AlbaCore Capital Group, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners, all of which are part of the First Sentier Investors group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311).

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188).

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB).

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167)

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested

© First Sentier Investors Group

IMPORTANT INFORMATION

This document has been prepared by Count Limited (Count) ABN 11 126 990 832. While care has been taken in the preparation of this market update, no liability is accepted by Count, its related entities, agents and employees for any loss arising from reliance on this market update. Count advisers are authorised representatives of Count.