July 2025

Australian Interest Rates Fall Again

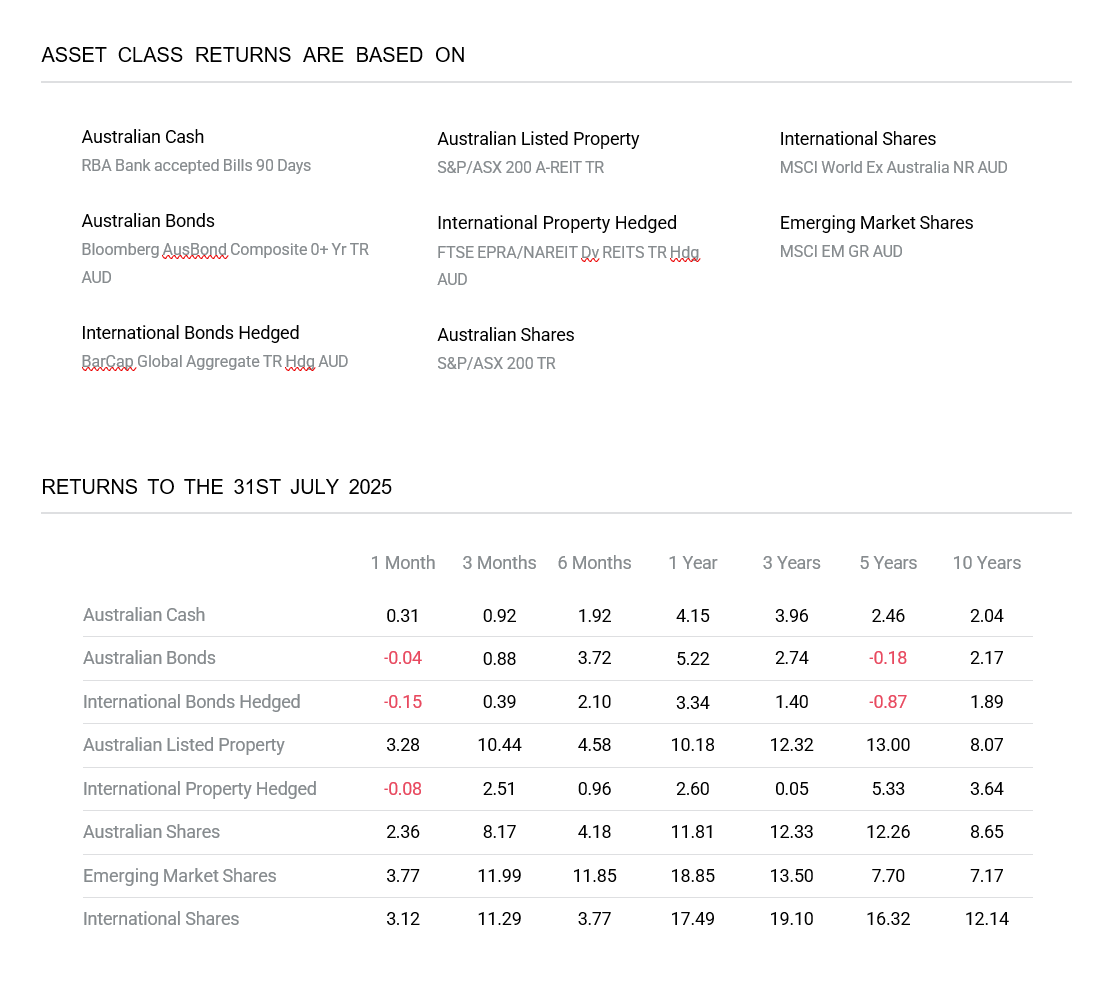

It was another strong month for financial markets in July. The Australian share market increased 2.40% whilst global shares increased +3.10% in Australian dollar terms. This was the fourth consecutive month of gains. The rally was driven by stronger US company profit reports, easing trade tensions, stronger US economic data and in Australia a better inflation reading. The lower inflation reading saw markets factor in a reduction in the RBA cash rate which was subsequently delivered at the Reserve Bank’s meeting in August. In Australia the cash rate now stands at 3.60%. The RBA cited improved inflation data, to justify the reduced cash rate. Financial markets continue to aggressively price in interest rate reductions by the RRBA. However, it is unlikely that an aggressive rate cutting cycle is forthcoming.

Australia’s growth backdrop remains resilient and housing activity and housing inflation suggests that there is a limit in the scope for further aggressive easing. The NAB Business Survey showed moderating current conditions but expectations were much improved. Capacity utilisation remains elevated, and forward orders have shown momentum. Retail sales and the labour market point to underlying economic resilience and rising activity. It all looks rosy however, if there was an economic indicator that may concern financial markets, it is the underlying trend in the labour market. The labour market data suggest a gradual softening trend is re-emerging. July’s employment gain of 24,500 was barely able to offset two months of close to zero net job creation.

The unemployment rate has also started to increase, reaching 4.3% at the latest reading. The rise has been driven by an increase in youth unemployment – a labour market cohort more sensitive to changes in the business cycle. It signals a broader lift in total unemployment is likely.

In the US, retail sales and consumer sentiment data point to slowing underlying momentum despite headline resilience. Retail sales increased by a weaker than expected 0.5% in July, from 0.9% in June. June data was revised higher, however much of July’s strength appears to be a one-off, with large retailer discounting and unusually strong vehicle sales ahead of the September 30 expiry of federal EV subsidies. Spending on food services, fell 0.4%. Retail sales are skewed toward goods and are not inflation-adjusted, implying some nominal gains likely reflect tariff-related price effects rather than stronger demand. Inflation adjusted goods spending growth remains positive but is slowing.

The University of Michigan Consumer Sentiment index fell to 58.6 from 61.7, with weaker current conditions suggesting July’s retail sales strength will be hard to sustain. Inflation expectations increased to 4.9% from 4.5% (1-year) and 3.9% from 3.4% (5–10 year), a shift unlikely to be welcomed by the Federal Reserve Bank members hesitant over a September rate cut. While inflation is set to rise modestly, downward revisions to jobs data are a clearer signal of the slower growth trajectory.

In Europe, tighter financial conditions from a stronger EUR and higher German 10-year bond yields are weighing on growth. These headwinds were evident in weak German factory orders. The ZEW index, a reliable gauge of European growth momentum has stalled recently suggesting trend like economic. Europe’s core inflation held steady at 2.3% in July – for a third consecutive month. Goods inflation was higher, coming from a low base however, services inflation trended down again and now stands at 3.1%. Wage growth continues to show signs of moderation which is a good sign that core inflation should remain close to the ECB’s target for the foreseeable future. ECB President Christine Lagarde emphasised that inflation is under control, the economy is growing, and the labour market is strong.

Lastly, in China, economic activity slowed across the board with retail sales, fixed asset investment and value added of industry growth all reaching the lowest levels of the year. After a strong start, several months of cooling momentum suggest that the economy may need further policy support. New home prices fell 0.31% over the month, retail sales slowed to 3.7% over the year from 4.8% and industrial production eased. Flooding disrupted infrastructure spending beyond seasonal norms, while household consumption lost support after local governments exhausted subsidy funds in June. Despite faster fiscal disbursements earlier in the year, proceeds were used mainly for debt repayment, not investment. The accelerating downturn in property prices in the past few months signals that further policy support is needed.

Given the high exposure of Chinese households to real estate, establishing a trough on prices is an important factor to restoring confidence and generating a sustained consumption recovery. This is particularly important as domestic demand is targeted to become an increasingly important economic driver. It’s difficult to expect that consumers will spend with greater confidence if their biggest asset continues to decline in value. Fiscal and monetary policy remain aimed at containing downside risks rather than driving a recovery. This is likely to persist to the end of 2025.

The rally in the Australian share market was driven predominantly by the improvement in tariff‑related sentiment and rising commodity prices following the start of construction on the world’s largest hydroelectric project in China. The Medog Hydropower Station will be three times the size of the gigantic Three Gorges Dam and produce up to 60GW of power, similar to the total capacity of Australia’s National Electricity Market. The scale of the project contributed to positive sentiment towards commodity demand Sector rotation was evident, with financials underperforming resources. HealthCare (+8.7%) was the best-performing sector over the month, led by CSL (+13.1%) and Pro Medicus (+12.9%) while Financials ex REITs (-0.9%), dragged down by Macquarie Group (-4.9%) and Commonwealth Bank (-3.7%), underperformed the broader market but remains expensive. At a stock level, the best performers included Mineral Resources (+32.6%), AMP (+26.9%) and Life360 (+24.7%) while Northern Star (-16.0%), Telix Pharmaceutical (-3.8%) and Evolution Mining (-8.7%) were amongst the biggest laggards.

The global outlook continues to be influenced by ongoing tariff negotiations. Whilst an all-out trade war was averted which lessened the chance of recession, global growth remains sub-par. Lower interest rates in Australia, China, Europe and eventually the US should underpin growth, but this could be neutralised by stubbornly high bond yields.