July 2024

Economic and Market Overview

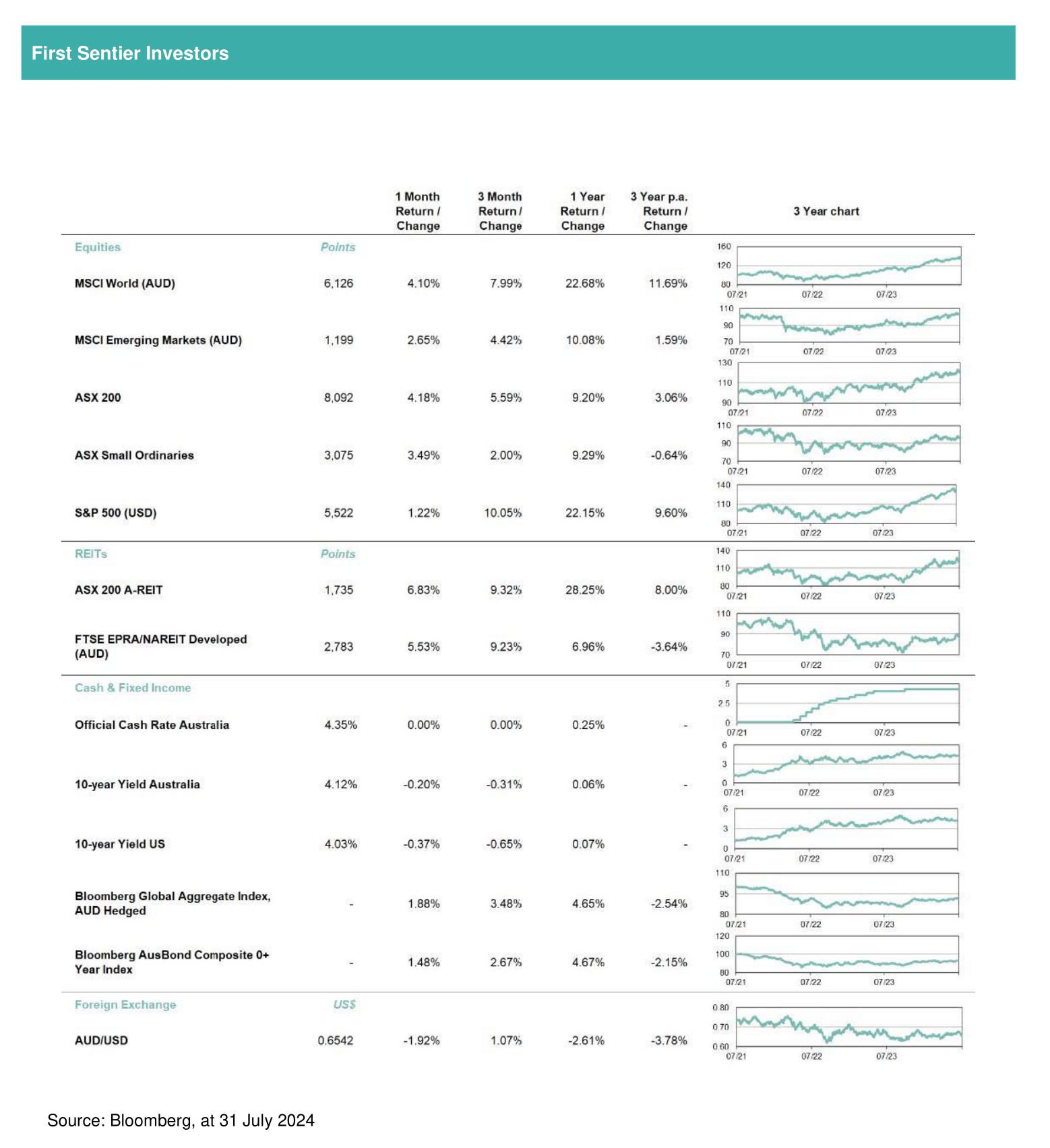

- Australian shares fared well in July, buoyed by suggestions that no further interest rate hikes will be necessary.

- With inflation coming off the boil, there was optimism that borrowing costs have peaked and could be lowered later this year. In turn, this could be beneficial for corporate earnings.

- Returns from overseas shares were positive too, albeit partly owing to weakness in the Australian dollar which boosted returns from offshore investments.

Fixed income also fared well, both in Australia and offshore. Yields trended lower, which translated into favourable returns from bond markets.

US: It appears the US remains on track for a ‘soft landing’, with inflation slowing and GDP growth remaining intact.

- The world’s largest economy grew at an annualised rate of 2.8% in the June quarter, which was an acceleration from the first three months of the year and above consensus forecasts.

- Pleasingly, inflation continues to moderate. The headline and core measures of CPI in the US both ticked lower in June, which will have been welcomed by Federal Reserve policymakers.

- The latest labour market indicators were less encouraging. Fewer new jobs were created in June than in the previous month and the number for May was revised downwards. The official unemployment rate also ticked up by a tenth of a percentage point, to 4.1%, and above central bank projections.

- With wage growth moderating too, investors appear convinced we are on the brink of a major policy easing cycle in the US. The Federal Reserve left official interest rates unchanged at its meeting in late July, but markets are pricing in the prospect of around 1.75% of rate cuts in the next 18 months or so Forecasts suggest the first cut could occur as soon as September.

- Such aggressive policy action has only historically occurred during recessions, suggesting current forecasts could overestimate the extent of easing if the economy remains on its current growth trajectory.

- July was a big month on the political scene too, with a failed assassination attempt on Republican presidential nominee Trump and the subsequent withdrawal of President Biden from the race. Current Vice President Kamala Harris is the new nominee for the Democrats and, if elected, will become the first female president.

- Historically the US equity market has lacked direction in the months preceding presidential elections, before rallying after the event as the new administration outlines its growth plans.

A Trump victory could be perceived as positive for listed companies owing to his ‘America first’, pro-business policies and promises to lower corporate tax rates. Opinion polls might therefore be worthy of attention ahead of the election in early November.

Australia: The release of inflation data for the three months ending 30 June 2024 was the primary focus for local investors.

- The ‘trimmed mean’ measure, favoured by Reserve Bank of Australia officials, showed consumer prices rising at an annual rate of 3.9%. This was a slight slowdown from the first quarter of the year and was also below consensus forecasts.

- Inflation remains comfortably above the Bank’s 2% to 3% target, but it appears to be moving in the right direction and forwardlooking- interest rate expectations moved as a result. Investors no longer expect policymakers to increase interest rates any further – either at the next Reserve Bank of Australia meeting on 6 August, or later – and there are renewed hopes for a possible 0.25% rate cut before the end of 2024.

- The trimmed mean measure of consumer price inflation has now fallen for six straight quarters, from a peak of nearly 7% year-on-year in late 2022. In turn, there is optimism that Reserve Bank of Australia officials will succeed in bringing inflation back within the 2% to 3% target band during 2025.

As well as confirming whether the official cash rate will remain at 4.35%, officials will provide updated economic growth forecasts following their meeting on 6 August. Employment growth was much stronger than expected in June, but retail sales growth has been less strong. This suggests Australians remain concerned about living costs and that higher mortgage interest payments are eroding purchasing power. To help support growth, policymakers could therefore be inclined to lower interest rates if inflation continues to slow.

New Zealand: The Reserve Bank of New Zealand left interest rates unchanged at 5.50% at its July meeting, but a biggerthan-expected drop in inflation in the June quarter suggests policymakers have scope to ease policy settings in the period ahead. Current forecasts suggest borrowing costs could be lowered by 0.25% in August, with two further cuts possible before the end of the year.

Europe: GDP data for the second quarter of 2024 were released in the Eurozone. The German economy – the largest in the region – shrank by 0.1% over the period, although growth was reported in the three next biggest economies (France, Spain and Italy).

- With inflation in the Eurozone continuing to moderate, another rate cut in September has been fully priced into the market following June’s initial cut.

- As anticipated, the Labour Party swept to victory in the UK’s general election, ending 14 years of Conservative rule.

- With the election out of the way, the Bank of England lowered

interest rates by 0.25% at its meeting on 1 August. This was the first UK rate cut for four years and could help soften the impact of higher taxes, which are expected to be announced as the new government looks to improve the country’s budget position.

Asia: Chinese GDP grew at the slowest pace for five quarters in the three months ending 30 June. Residential property prices continued to fall and retail sales growth slowed, suggesting domestic demand is weakening. This will likely be concerning for officials, particularly since subdued export orders are clouding the outlook for the manufacturing sector.

- Factory output in China slowed for a third consecutive month in July, which does not augur well for the achievement of Beijing’s 5% annual GDP growth target.

- Interest rates on one- and five-year prime loans in China were lowered, as authorities tried to underpin activity levels and support the beleaguered property sector.

- Elsewhere in Asia, the Bank of Japan raised interest rates from 0.10% to 0.25%; a move that had been widely anticipated and well telegraphed by central bank officials.

Australian Dollar

- The AUD performed quite well in early July, but lost ground in the second half of the month – particularly following the release of the latest quarterly inflation data. The fading prospect of further interest rate hikes in Australia took the wind out of the sails of the currency. The AUD closed July at 65.4 US cents; its weakest level in three months.

- The AUD behaved similarly against other majors, initially appreciating but ending the month down nearly 2% against a trade-weighted basket of international currencies.

- Notably, the AUD lost significant ground against the Japanese yen following six months of gains. The exchange rate moved by more than 7% after the Bank of Japan raised official cash rates.

Australian Equities

- Australian shares rallied strongly in July, supported by growing expectations for a September rate cut in the US and betterthanexpected inflation data locally that eased concerns about a possible rate hike in Australia.

- The S&P/ASX 200 Accumulation Index returned 4.2%, its strongest monthly performance so far in 2024, on the back of solid contributions from some of the largest stocks in the index including Commonwealth Bank, Wesfarmers, and CSL.

- The Consumer Discretionary sector (+9.1%) led the charge. Stocks in this area of the market were buoyed by encouraging June/July retail sales numbers and optimism that Australian interest rates will not be raised any further. Harvey Norman was among the strongest performers, adding almost 15%. Wesfarmers (+13.0%) benefited from strong sales numbers.

- At the other end of the scale, Utilities (-2.9%) lagged despite a lack of material company updates ahead of August’s ‘reporting season’. Sentiment appeared to be affected by the expiration of the coal cap on 1 July, where contract prices were capped at $125/tonne versus spot coal prices of $130-135/tonne. The change will result in higher input costs for power producers, at a time when electricity prices have levelled off. This raises the prospect of margin erosion for companies like AGL and Origin.

- Paladin (-8.6%) and Boss Energy (-11.6%) were among the worst performing stocks in the Energy sector, as the spot uranium price declined following a strong run over the past year.

- Small caps also fared well, with the S&P/ASX Small Ordinaries

- Index adding 3.5%. Small Materials stocks underperformed Industrials, reflecting a continuation of weakening commodity prices on the back of softer demand signals from China

Global Equities

- Returns from global share markets were mixed in July and the MSCI World Index lacked direction overall. That said, returns for Australian investors were positive owing to weakness in the Australian dollar.

- In the US, there was a notable rotation away from technology stocks and into more defensive areas of the market. The techheavy NASDAQ had risen nearly 20% in the first half of 2024 and a pause for breath was therefore not a major surprise as investors banked profits from the recent rally.

- Weakness in tech-related names also acted as a drag on the S&P 500 Index, which closed the month lower in local currency terms. The Dow Jones Industrial Average – which is exposed to more established American firms, with a lower technology weighting – fared better.

- Among major names, Tesla’s latest earnings and vehicle sales disappointed investors, while Apple reported ongoing weakness in iPhone sales in China. Elsewhere, fast food chain McDonald’s reported the first drop in quarterly sales since 2020. More positively, investment bank J.P. Morgan announced record profits.

- In Asia, China’s CSI 300 and Hong Kong’s Hang Seng Index lost ground, reflecting ongoing concerns about the GDP growth outlook in China.

- Japan’s Nikkei 225 also performed poorly, down 1.2% over the month, although Singapore’s Straits Times fared much better and made positive progress.

- Elsewhere in the region, the biggest labour union representing Samsung employees in South Korea announced planned strike action. This could have implications for memory chip supply globally, potentially delaying shipments of electronic goods.

- Returns from European markets were mixed. Stocks in Italy, Spain and Switzerland were among the top performers, while the French market closed lower. Sentiment towards French stocks was adversely affected by political uncertainty, after none of the coalition parties were able to win a majority in the election.

- Germany’s DAX also underperformed some regional peers, following subdued GDP growth readings and after Deutsche Bank reported its first quarterly loss in four years.

- Collectively, the Euro Stoxx 50 Index was little changed over the month.

Property Securities

- The FTSE EPRA/NAREIT Developed Index closed July 5.5% higher in AUD terms, aided by solid performances from markets including Canada (+10.0%) and the US (+6.2%).

- The Bank of Canada lowered interest rates by 0.25% for a second consecutive month, which boosted sentiment towards property stocks in that market. Similarly, speculation that the Federal Reserve is preparing to ease policy settings in the US in September – with multiple cuts expected thereafter – led to stronger performance from US property names.

- Laggards included Hong Kong, Spain, and Switzerland, although all markets registered positive returns.

- Australian property stocks added 6.8%. Investors are hoping AREITs are near the end of the devaluation cycle and expect transactions and asset values to improve in 2025.

Fixed Income and Credit

- Downward moves in yields in major fixed income markets boosted returns from bond indices and helped the Bloomberg Global Aggregate Index return 1.9% in AUD terms.

- Most notably in the US, yields on 10-year Treasuries closed the month 0.37% lower. Investors became increasingly confident that the Federal Funds rate will be lowered in September, with further significant cuts anticipated thereafter.

- In fact, the difference in yield between 2- and 10-year Treasurie narrowed to its smallest margin for two years, indicating that investors are anticipating meaningful interest rate cuts in the near term. The Treasury curve steepened against this background.

- Sovereign bond yields fell in Germany and the UK too. The probability of policy easing increased following the latest inflation data and other economic indicators in Europe.

- Despite the rate hike in Japan, yields on Japanese Government Bonds were little changed over the month.

- Locally, yields on 10-year Australian Commonwealth Government Bond yields closed July 0.20% lower. Again, this supported positive returns from the domestic fixed income market. The Bloomberg AusBond Composite 0+ Year Index returned 1.5%, extending gains in the calendar year to date.

- In the corporate credit space, spreads stablished after widening in June. The prospect of interest rate cuts in key regions and lower financing costs for companies should help minimize default risk, particularly if corporate earnings continue to grow.

- Demand for credit improved against this background, helping corporate bonds generate positive returns and claw back some of June’s lost ground.

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should consider, with the assistance of a financial advisor, your individual investment needs, objectives and financial situation.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

About First Sentier InvestorsReferences to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors, Realindex Investments and Igneo Infrastructure Partners, all of which are part of the First Sentier Investors group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311).

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188).

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers, Stewart Investors, Realindex Investments and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), Realindex Investments (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

- Japan by First Sentier Investors (Japan) Limited, authorised and regulated by the Financial Service Agency (Director of Kanto Local Finance Bureau (Registered Financial Institutions) No.2611).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB).

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167).

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group