December 2025

Economic and Market Overview

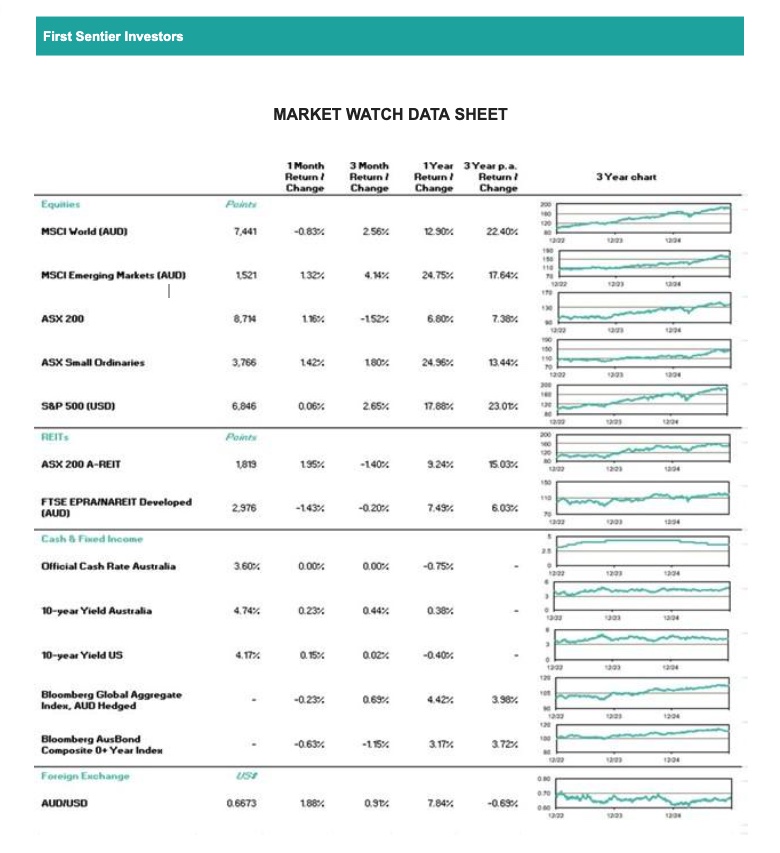

- Global: Cross-asset performance was mixed in December, with metal prices rising, while developed market bond yields broadly moved higher and global equities were mixed.

- Bond yields moved higher at the beginning of the month, driven by concerns that the global rate cutting cycle was nearing an end. While the 25bp cut from the Fed assuaged these concerns, it led to a divergence among global central banks, with further cuts priced in for the US and UK, while Australia, New Zealand and Canada saw a pivot to pricing rate hikes in 2026.

- Equity markets saw mixed performance during December, with Europe’s STOXX600 gaining +2.7%, while major US indices were mixed, with the S&P500 and NASDAQ seeing monthly losses. The MSCI World Index traded +0.7% higher on the month.

Silver and gold prices both reached record highs during the month, following the interest rate cut from the Fed and ongoing supply pressures. Despite a pullback into month end following changes to margin requirements from the CME, silver closed +26.8% higher, while gold notched a +1.9% gain.

US: The Fed cut policy rates by 25bps to 3.50% - 3.75% at its December meeting, in line with expectations. Chair Powell advised that rates were in the “broad range” of neutral and that future decisions would be made on a meeting-by-meeting basis. At month end, markets had fully priced in two further rate cuts from the Fed in 2026.

- The delayed October and November employment data showed a 41k cumulative decline in payroll employment, largely due to federal workers accepting deferred resignation offers earlier in the year. Private employment increased by +121k. The unemployment rate rose to 4.6%.

- US equities were mixed on the month, with the DOW advancing +0.7%, while the S&P500 and NASDAQ declined -0.1% and 0.5% respectively.

- Retail sales printed flat in October and were revised slightly lower in September, to +0.1% MoM.

- November Core CPI rose +2.63% YoY, softer than consensus +3.0% YoY. Notably, there were likely measurement issues related to the lack of data collection during October and early November.

- Q3 real GDP increased +4.3% QoQ, above consensus expectations for +3.3% QoQ. Stronger real consumer spending drove the upside surprise, advancing +3.5% during the quarter. The trade deficit continued to shrink, with declining imports contributing to stronger than expected growth.

- Conference Board consumer confidence declined to 89.1 in December, down from an upwardly revised 92.9 in November. The labor market differential continued to fall, declining to 5.9.

The DXY depreciated -1.1% during December, declining fairly steadily throughout the month on the Fed interest rate cut and soft economic data.

Australia: During December, the bond market pivoted from pricing further monetary policy easing in 2026 to expecting rate hikes.

- The RBA kept interest rates on hold in December, as widely expected. While the statement was quite neutral, the press conference was more hawkish, with the Governor removing the easing bias for 2026.

- The ASX200 advanced +1.2% during the month, led by gains in major banks on hawkish rate expectations into 2026 and mining stocks on strong commodity prices.

November Labour Force Data saw the economy lose -21.3k jobs, weaker than consensus expectations for +20k new jobs. The unemployment rate remained unchanged at 4.3%.

New Zealand: Q3 GDP increased by a stronger than expected +1.1% QoQ. Consensus expectations had been revised upwards from +0.8% to +0.9% ahead of the print. While Q2 was revised down to -1.0%, yearly GDP was in line with expectations, at +1.3% YoY.

During the month, the market priced out any further rate cut expectations from the RBNZ, changing to price the chance of hikes in 2026.

Europe: European equities saw some of the strongest gains among its global peers during December, with the STOXX600 up +2.7%, while the UK’s FTSE100 advanced +2.2%. The STOXX600 and FTSE100 both reset their record highs just before month end, boosted by strength in commodity-linked stocks.

- The European Central Bank held interest rates mid-month at 2%, as widely expected. Both growth and inflation expectations were revised upwards by the Governing Council of the ECB. The Bank of England cut interest rates by 25bps to 3.75%, in a tight 5-4 vote. This marked the sixth interest cut from the central bank since August 2024.

- Euro area HICP was slightly higher than expected, at 2.2% YoY in November against 2.1% YoY expectations. Core inflation remained steady at 2.4% YoY.

- UK Headline November CPI printed below expectations for +3.5% YoY at +3.2% YoY. The headline, core and services figures all missed expectations.

UK October GDP underperformed consensus expectations, at 0.1% on both a MoM and quarterly basis. This was below +0.1% MoM and flat quarterly expectations.

China: The Politburo held its final meeting for 2025, during which overall policy continuity was signalled, with social stability and high-quality development remaining the key policy goals.

- Export growth rebounded in November, to +5.9% YoY (above expectations for +4.0% YoY), while imports growth was +1.9% YoY. This saw the monthly trade surplus lift to a five-month high in USD terms.

- November CPI rose to +0.7% YoY, broadly in line with expectations and up from October’s +0.2% YoY. The recovery was driven by vegetable prices, with food prices up +0.5% MoM.

- Retail sales rose +1.3% YoY in November, below market expectations for +2.9% YoY. Auto sales was the largest drag on overall retail sales, declining -8.3% YoY, potentially due to a pullback in government subsidies.

- December manufacturing PMI rose to 50.1, up 0.9 from November and above consensus expectations for 49.2. This was the first month of expansion after eight consecutive months of contraction. Non-manufacturing PMI also returned to expansion in December, up 0.7 to 50.2, above consensus 49.6. This was in part due to a recovery in construction, which accelerated to six-month highs of 52.8.

Australian dollar

- The AUD gained +1.9% against the USD during December, closing at 0.6673.

- The AUDUSD pair traded a 181-pip range, opening at its month lows and reaching its highest level near the end of the month, at 0.6725.

- The AUD gained steadily into the middle of the month on the back of diverging monetary policy rate paths between the US and Australia, with further rate cuts expected in the US into 2026, while the RBA removed its easing bias at its December meeting.

- Weaker than expected Australian labour force data eased some of the hawkish sentiment as the month progressed, reversing some of the gains in the Aussie. The Australian economy lost -21.3k jobs in November, against expectations for +20k new jobs.

- The AUD recovered sharply into month-end, boosted mechanically by softer US economic data that reiterated expectations for further rate cuts from the Fed.

- The Aussie Dollar touched its month high of 0.6725 on 29 December, before closing the year at 0.6673.

Australian equities

- The ASX200 gained +1.2% during the month, notching a +6.8% yearly gain.

- Materials led the index in December, with the sector advancing +6.6%. Mining giants BHP and RIO gained +9.2% and +11.0% respectively, boosted by broad gains in commodities during the month.

- Copper stocks CSC and SFR advanced +14.9% and +13.9% each following a +7.8% increase in underlying copper prices.

- Gold miners saw some of the largest percentage gains in the sector, with GGP and BGL gaining +38.9% and +28.7% respectively. Large cap gold miners EVN and NEM increased +6.7% and +7.7% each. Gold prices reset its record high close at US$4533.21/oz near month-end, before paring gains on changing margin requirements from the CME.

- The Financials complex advanced +3.4% on the month, led by the banks. The major banks saw gains after the RBA removed the easing bias, with the bond market pricing in the chance of a rate hike in 2026 NAB +5.5%, CBA +5.3%, ANZ +4.9%, WBC +2.7%.

- Tech stocks underperformed, with the sector down -8.7% during the month. All stocks in the sector declined, tracking losses in large cap US tech stocks and increased rate expectations locally.

- REITs were mixed on the month, with the sector closing +0.8% higher. Sector heavyweight GMG saw the largest percentage gain in the sector, up +4.4%. GMG advanced following the announcement that it had formed a JV with CPP Investments for a $14bn European data centre partnership, which included a $3.9bn initial total capital commitment.

- Elsewhere in the sector, residential REITs MGR and SGP saw declines following a more hawkish rate outlook into 2026. They declined -5.1% and -4.8% respectively.

- DRO saw the largest percentage gain on the index, up +55.6% after announcing multiple new contracts throughout the month, including a $49.6m European military contract.

Global equities

- Global equities were mixed in December, with the MSCI Word Index gaining +0.7%. US equity indices diverged, with the NASDAQ and S&P500 declining -0.5% and -0.1% respectively, while the DOW advanced +0.7%. Despite finishing the month lower, the S&P500 reset its record high close during December.

- Large cap tech stocks underperformed towards the end of the month on renewed AI investment concerns. Broadcom saw one of the largest percentage declines in the sector, down -14.1% on the month. The stock traded over -11% lower after reporting a beat and raise for Q4, however guided gross margins lower than expected.

- European equities saw some of the strongest gains, with the STOXX600 up 2.7% and the FTSE100 up 2.2%.

- Basic Resources led the STOXX600, with the sector up +10.3% on the month due to broad strength in commodities. Fresnillo +26.6%, Antofagasta +18.9%, Glencore +12.7%.

- The Food, Beverage and Tobacco sector underperformed the index, down -1.4%. Alcoholic beverage companies saw some of the largest percentage losses following a slew of divestments in the sector announced during the month. Pernod Ricard -5.8%, Diageo -7.6%.

- The MSCI Asia Pacific Index increased +2.0% on the month, driven by gains in Korea (+7.3%) and Taiwan (+4.8%). Hong Kong and China H-Shares weighed on the region, down -4.6% and -2.4% respectively.

Property securities

- Global property securities had a softer December month, down 1.0% after a positive November. This brought down CY25 returns to a still strong ~11%. The movements reflected rising inflation and longer-term interest rates globally, as well as rising geopolitical concerns.

- The Americas region underperformed the Global average, down -2.2% in December, driven again by elevated interest rates and uncertain near-term rate expectations.

- Europe/UK returns were positive in December (+1.0%) and outperformed the global December average. Europe/UK performed strongly in CY25 with ~21% total return.

- The Asia Pacific region returns outperformed global averages but had a small positive month (+0.4%) in December, following a strong November (+1.6%). The key drivers were Japan and Singapore which continued to see stronger returns, with some gains seen in HK property sector as well. The APAC region outperformed global averages in CY25 with ~23% returns.

- Locally, AREITs were up +0.8% in December, after a weaker November (-4.0%). Despite higher CPI and rate hike fears, the positive sector return reflected a +4.4% rally in GMG following its data center partnership in Europe. On the other hand, rate sensitive names, particularly residential exposed, underperformed in the month with fears of negative impacts from rate hikes. In CY25, AREITs were up ~6%.

Fixed income and credit

- December saw a divergence in global central bank expectations, with the market continuing to price further rate cuts from the UK and US central banks, while pivoting to expect rate hikes from Canada, Australia and New Zealand in 2026.

- Alongside these rate expectation changes, developed market bond yields traded higher in the first week of December following hawkish commentary from several Fed Presidents. Yields remained steady after the Fed delivered a 25bp cut, trading rangebound into year-end.

- 10yr US Treasury yields closed +15.4bps higher at 4.169%, while the 2yr Treasury yield finished 1.6bps lower at 3.475%.

- Locally, murmurs of a potential rate hike from the RBA in February saw yields move higher. This gained further momentum after the RBA held rates at its December meeting and removed its easing bias for 2026 in its press conference. The 2yr AU government bond yield finished December +24.9bps higher at 4.056%. The 10yr yield closed +22.6bps higher at 4.741%.

- US credit spreads traded tighter on the month, with investment grade credit spreads finishing December 1.11bps tighter, while high yield spreads closed 5.98bps tighter.

Important information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should consider, with the assistance of a financial advisor, your individual investment needs, objectives and financial situation.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Certain of our investment teams operate under the trading names AlbaCore Capital Group, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners, all of which are part of the First Sentier Investors group. We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311).

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188).

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB).

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167)

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested

© First Sentier Investors Group

IMPORTANT INFORMATION

This document has been prepared by Count Limited (Count) ABN 11 126 990 832. While care has been taken in the preparation of this market update, no liability is accepted by Count, its related entities, agents and employees for any loss arising from reliance on this market update. Count advisers are authorised representatives of Count.