August 2025

One further cut by the RBA and that should do it.

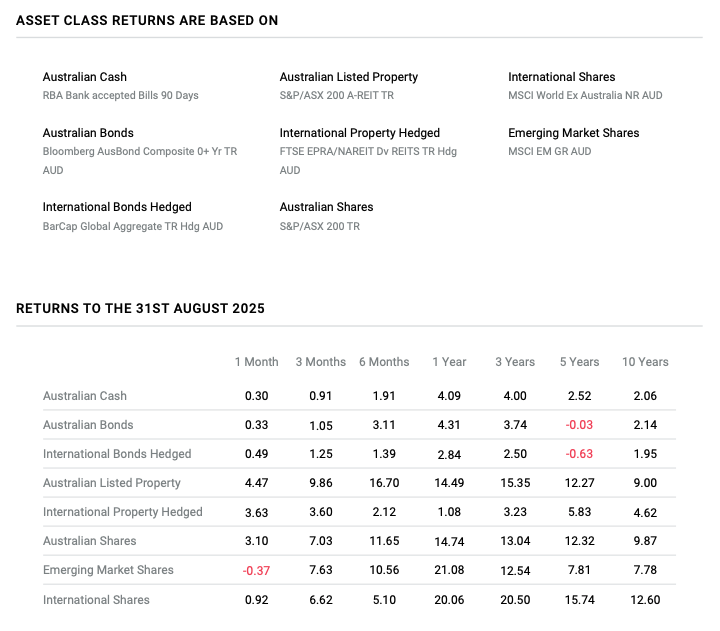

Share and bond prices increased in August following a better profit reporting season in the US and a softer reading in labour force data suggesting a reduction in interest rates is imminent. The Australian share market increased by 3.10% and global shares by 2.1% as represented by the MSCI World Index in Australian dollar terms. Australian Listed Property and International Property returned 4.47% and 3.63% respectively. Bond prices slightly underperformed the cash market as bond yields remained under pressure on fears of inflation will remain high in the US driven by the tariffs.

The stock market rally was driven by a combination of strong US corporate earnings and increased expectations for a series of interest rate reductions by the Federal Reserve as markets focus on a weakening of the labour market. The US economy appears to have stagnated since the last FOMC meeting with most districts reporting little to no increase in economic activity or employment. This anecdotal evidence corroborates the much slower pace of payroll growth following downward revisions and keeps a series of upcoming rate cuts likely. Importantly, the labour report showed a jobs market that is weakening but not collapsing. As was the case last month, the "low hiring, low firing" regime persists, and should limit services inflation. Goods inflation is a different story and is pushing overall inflation higher.

This week brought us conflicting inflation data with producer prices cooling in August, but consumer prices heating up. Neither event changed investors' minds on the Federal Reserve's path for interest rates at its meeting coming up in September. US core consumer prices increased circa 3.1% and likely heading higher in the coming months on account of the tariff impact. Core goods inflation recorded 1.5% over the year from 1.1%, while services was roughly steady at 3.6%. US housing data remain weak, reinforcing a fragile growth backdrop. Elevated mortgage rates are a headwind and with consumer spending slowing, residential investment remains a drag on GDP growth.

The Australian economy grew by 0.6% over the quarter to June 2025 to be 1.8% over the year. This is a welcome turn around however the growth rate still remains "light". Stronger consumer spending underpinned the growth numbers as incomes increased 4.1% over the year. Tax and interest rate cuts, moderating inflation and retailer discounting all helped underpin a positive consumer. Since the easing of monetary policy last month, financial markets have questioned the extent of upcoming easing by the RBA due to the better economic data and an upside surprise to inflation as highlighted by the consumer price index. The data suggests one further reduction in the cash rate before the RBA moves to a neutral stance.

In China key activity readings fell short of market forecasts in August. In particular, retail sales growth of 3.4% over the year marks the lowest reading since November 2024. Industrial production growth of 5.2% was also the lowest in 12 months. Fixed-asset-investment was dragged down by real estate investment and soft private sector investment. This deceleration can no longer be simply explained away as a temporary weather-related blip. As highlighted in our reports over the past 5 months, growth has been slowing with data generally falling short of market forecasts.

Consumer confidence remained the biggest drag on the domestic economy owing to the continued weakness in the property market. The 70-city sample of property prices showed new home prices down -0.3% and used home prices down -0.58% over the month. Both declined at around the same rate as July. While 13 cities saw rising new home prices, only one saw rising used home prices. This suggests pressure on homeowners continues. It suggests that there is a strong case for additional short-term stimulus. Analysts expect another 0.10% rate reduction and 0.50% reduction to the reserve-requirement-ratio.

Lastly, in Europe, the central bank left monetary policy unchanged with the Governing Council confident of a soft landing. Markets barely reacted, consistent with a fully discounted decision. Domestic activity has held up despite weaker US demand, but punitive tariffs from the US-EU deal have weighed on confidence, which has yet to recover. Near-term growth momentum has slowed and remains flat. Financial conditions remain tight, with a strong euro and elevated German bond yields weighing on growth. On a positive note, Europe's periphery economies continue to reduce debt which will support consumption. On the negative side of the ledger, external risks such as Chinese yuan depreciation or a slowdown in the US will see a further easing by the ECB. The risks remain balanced.

The Australian and US share markets remain expensive overall but there are pockets of value suggesting that further market rotation is likely in the near term. We remain concerned that the meddling with the Federal Reserve coming from the Trump administration. This is problematic when viewed through the prism of perhaps rates being cut by too much. Furthermore, given that the fiscal situation has not improved in the US, we may be seeing a stagflationary environment build.