Current Rules and Regulations

Until recently, Australia's aged care system was currently governed by the Aged Care Act 1997, which set out the framework for residential care, home care, and associated funding. Under this regime, residents paid a combination of fees:

- Basic Daily Fee: Paid by all residents, set at 85% of the single age pension.

- Means-Tested Care Fee: Based on income and assets, with annual and lifetime caps.

- Accommodation Payments: Either as a lump sum (Refundable Accommodation Deposit, RAD), daily payments (DAP), or a combination of both.

- Extra Services Fees: For higher standards of accommodation or additional services such as gourmet meals, premium TV channels and even hairdressing.

Government support was available for people who had limited means with the system designed to ensure access regardless of financial position.

Changes from 1 November 2025

Originally, the new Act and Support at Home program were set to commence on 1 July 2025. However, the government deferred the start date to 1 November 2025 to allow more time for sector readiness and finalisation of rules.

The New Aged Care Act 2024 came into effect on 1 November 2025, replacing the 1997 Act. The reforms are designed to:

- Place the rights and needs of older people at the centre of care.

- Improve transparency, sustainability, and fairness in funding.

- Strengthen regulatory oversight and quality standards.

What are the Key Changes

Fee Structure Overhaul: The new rules introduce two new contributions for residents that are means-tested. These are the Hotelling Supplement Contribution (HSC) and the Non-Clinical Care Contribution (NCCC).

The HSC covers accommodation-related costs including meals, cleaning and laundry. This fee was previously fully paid by the government direct to aged care providers to provide these services, but under the new rules, new age care residents will be required to contribute.

The NCCC covers non-clinical care such as mobility assistance, bathing and everyday living expenses. This replaces the Means Tested Care fee of the previous regime that some residents are required to pay. The services covered under the NCCC are not as comprehensive as those provided under the previous means tested fee.

Capping and Indexation: Daily and lifetime caps will continue to be placed on both contributions and will be indexed with CPI.

- Refundable Accommodation Deposit (RAD): Providers can now retain up to 2% per year for up to five years (max 10%) for new residents.

- Support at Home Program: Replaces Home Care Packages, with new funding provided and changes to assessment models.

- Rights-Based Framework: Stronger protections for residents, clearer complaint mechanisms, and a focus on dignity and choice.

- The cap for room prices of $550,000 without approval from the Independent Health and Aged Care increased to $750,000 on January 1, 2025.

- The Maximum Permissible Interest Rate (MPIR) for accommodation payments was reduced to 7.61% on October 1, 2025.

Who is Affected?

- All new residents entering care from 1 November 2025 will be subject to the new rules.

- Existing residents as of 31 October 2025 are "grandfathered" and remain under the old system.

Grandfathering Rules

What is Grandfathering?

Grandfathering ensures that individuals already in care before 1 November 2025 (or approved for a Home Care Package before 12 September 2024) continue under the old regime including fee and funding arrangements.

- If a resident leaves and re-enters care within 28 days, they will retain their grandfathered status.

- For home care, those approved before 12 September 2024 are protected under the old rules when transitioning to the new Support at Home program.

Why is this important?

- Residents who are subject to the Grandfathered provisions avoid sudden increases in their fees or changes to their funding model such as the Hotelling Supplement Contribution new residents are required to pay.

- Entry date is crucial for determining which rules apply.

- They will also not be subject to changes to the RAD that allows providers to retain up to 10% of the RAD on exiting the facility.

What is the Difference Between the Old and New Models

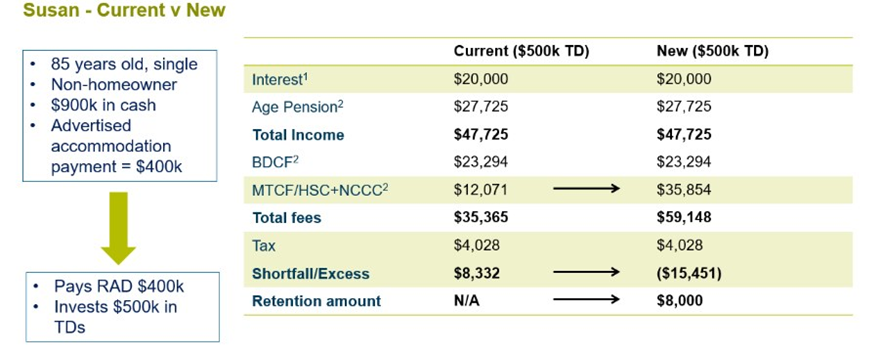

The introduction of the two new fees mean that the daily fees payable may be significantly more expensive for new residents as shown below.

Case Study: $400,000 Refundable Accommodation Bond & $500,000 in Term Deposit

Conclusion

- Grandfathering is Protective: Existing residents and home care recipients retain current arrangements.

- Fee Complexity Increases: New means-tested contributions and caps require careful modelling to maximise a new resident's situation.

- Professional Advice is Essential: Each client's situation is unique however advice opportunities may exist to provide residents a favourable outcome and ensure sufficient funding for the fees.