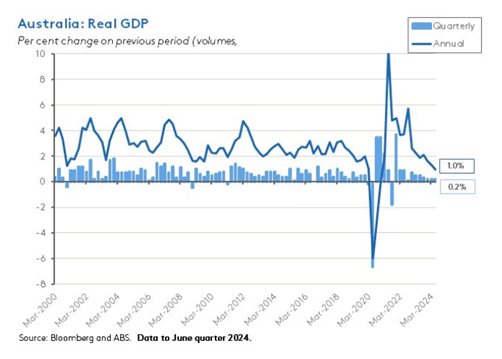

WSC Group have just finished the first round of management meetings with our business clients and the overarching theme of those meetings is that we have an economy wide downturn. That is, although the last quarter’s GDP Growth was 0.2 per cent in the June quarter 2024 Graph #1 below (and 1.5 per cent over the 2023-24 financial year) these numbers are aggregate GDP numbers and don’t take into consideration the GDP per capita in the economy (ie. what each person is producing individually).

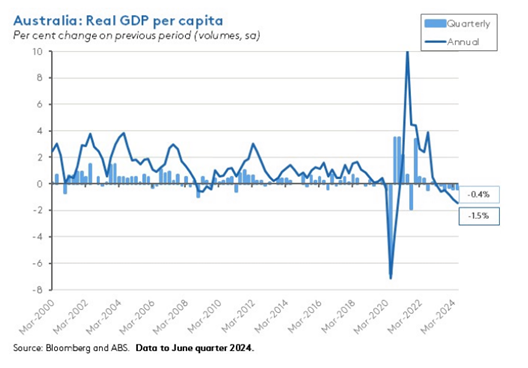

As you can see below, the real GDP per capita (person) in the economy has been steadily declining since June 2021. This represents the 6th consecutive quarter of negative per capita growth in Australia. In fact, Household consumption fell by 0.2%, the weakest growth rate since the COVID-19 lockdowns in the September quarter of 2021.

This always brings me to the same questions when the Reserve Bank of Australia keeps interest rates at restrictive levels for long periods of time. My questions are:

Should the Reserve Bank measure GDP on a per capita basis when it looks at the effect that its interest rates are having on the economy?

Should the inflation band between 2-3% be widened, particularly in times when inflationary pressures are caused by occurrences beyond the average Australian’s control?

Should we penalise small businesses in Australia, who are currently being liquidated in record numbers, so that inflation can be reduced from its current level at 3.8% (current core inflation) to be within the inflation band of between 2-3%?

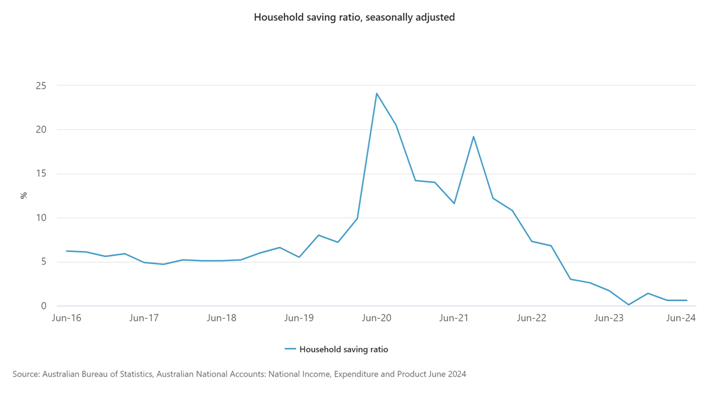

Now, forgive me if I have been a little technical in some of my reflections, however, I am sure that the average person is quite dumbfounded why mortgage holdersare paying up to 7% on their loans when there is a per capita recession. In fact, what high interest rates have done, is simply exhausted people’s household savings which we have been living off in the post-covid high-interest rate years that followed 2021.

All this always leads me to believe that the real economy is always neglected, particularly when it comes to institutions such as the Reserve Bank trying to micromanage an economy without really understanding the impacts on the average small business and individual.

We can only hope that some sanity will prevail early next year – with those that live in their ivory towers looking down and giving relief to those that really need it.

Let’s, however, keep doing what we are doing – working hard, building our businesses and continuing to build our long-term wealth despite the institutions that often hinder us in our quest for our goals. Please call us if you need some help with these goals you are working towards.