Post-Federal Budget – What you need to know

I’m sure by now you may have had an opportunity to look at some of the headlines in relation to the 2021/22 Budget which was just handed down on Tuesday night. It seems that these days, the amount of the budget deficit is no longer at the forefront of discussions when we talk about federal budgets.

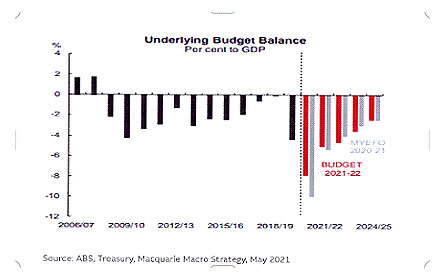

With an estimated budget deficit for the 2021/22 year estimated to be $106.6 billion, you wonder how our children, grandchildren and great grandchildren are ever going to pay this debt back. No best can this be expressed than by the following graph which illustrates the underlying budget balance as a percentage of GDP.

Although the budget deficits are large, they may be over-stated given that, for example, they’re based on an iron-ore price of $55 per tonne (current iron-ore price is $230 per tonne).

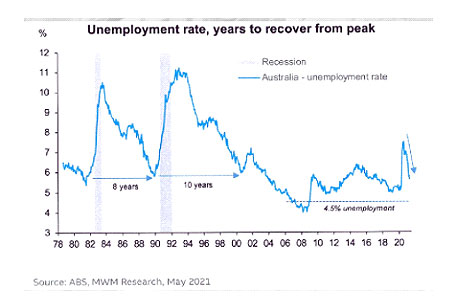

Unemployment is predicted to reduce significantly given the amount of stimulus the government is injecting into the economy. The below graph illustrates the unemployment rate which certainly dropped a lot since the mid-80s and 90s.

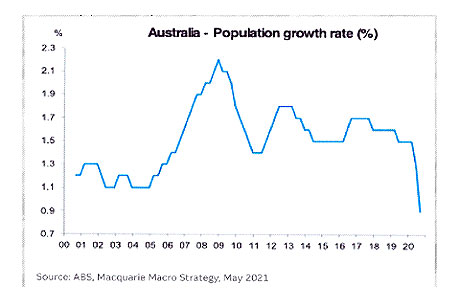

However, even though unemployment will be falling over the coming years, we need to quickly rescale our entire workforce given population growth is at historical lows as you can see in the below graph:

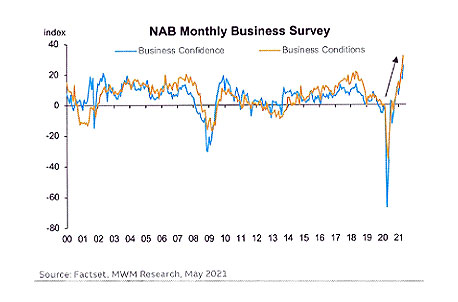

In good news, business confidence has completely recovered to pre-pandemic levels and the announcements made in the budget should continue to result in positive NAB monthly business surveys as seen below:

I think we’d all agree that if we’re going to live anywhere in the world, Australia might be the place of first choice at present.

The detail of the budget

I’ve categorized the main announcements into a few key areas.

Personal Taxation

- The Low- and Middle-Income Tax Offset and the Low-Income Tax Offset will be retained for the year into June 2022.

- Self-education expenses – a $250 threshold is to be removed from the first income year after the date of royal assent. This may be passed in time to take effect from July 1st, 2021.

- Residency tests - The government will replace the existing residency tests for tax residency with a clearly defined test whereby a person who is physically present in Australia for 183 days or more, in any income year, will be an Australian Resident for tax purposes. Individuals who do not meet this test will be subject to secondary tests, but these will depend on measurable and objective criteria. Presently the residency rules involved a lot of 'grey areas'.

- Medicare levy low-income thresholds for 2020-21 will be as follows (once legislated):

- Singles- $23,226 (up from $22,801 in 2019-20) and Couples with no children- $39,167 (up from $38,474 for 2019-20).

- The additional amount for each dependent child or student will be increased to $3,597 (up from $3,533).

- Seniors or Pensioners eligible for SAPTO $36,705 (up from $36,056 for 2019-20) and Senior and Pensioner Families $51,094 (up from $50,191).

- The tax exemption for ADF personnel will be extended to all personnel deployed to Operation Paladin from 1 July 2020. This just provides consistency for ADF personnel regardless of the operational area of their deployment.

Child Care Subsidies (CCS) to change from 1 July 2022

The government will make an additional $1.7 billion investment in childcare. Changes commencing 1

July 2022 include:

- Increase the childcare subsidies available to families with more than one child aged 5 and under in childcare by adding an extra 30 percentage point subsidy for second and third children (to benefit approximately 250,000 families).

- Removing the $10,560 cap on the CCS (stated to benefit 18,000 families).

Business Taxation

Temporary full expensing provision

The temporary full expensing provision will be extended to 30 June, 2023 which was otherwise due to finish on 30 June. 2022.

Clients should be aware however that:

- Retained earnings impact can prevent you from paying dividends.

- Can reduce your franking account balance.

- Can possibly impact on loans - servicing calculations.

Loss carry-back rules

Loss carry-back extended by one year to apply into the 2023 financial year. This will have an impact on your franking account which may limit your ability to pay franked dividends.

Changes to share scheme rules

These rules result in the cessation of employment removed as a taxing point for employee share scheme. This will take effect in the first financial year after the date of assent enabling the legislation.

Income from medical and bio-technology payments

Income derived from medical and bio-technology patents will be taxed at a concessional corporate tax rate of 17% from 1 July 2022.

Only granted patents which were applied for after the budget announcement will be eligible. The government is entering a consultation period about the design of the scheme before inception.

30% digital games tax offset

Will be introduced from 1st July 2022 for businesses investing a minimum of $500,000 in qualifying Australian Games expenditure, however games with gambling elements or games unable to obtain a classification rating will be excluded.

Other digital economy and natural disaster announcements

- Rules around the effective life for intangible assets, such as patents announcing that businesses will have the ability to self-assess the effective life on intangible assets like in-house software.

- Digital cadetships and a my-gov overhaul (as more practical guidance is received on these measures we will cover them in our monthly webinars).

- A tax exemption will apply to grants received by businesses affected by storms and floods. They will be considered non-assessable non-exempt income.

Superannuation

Work test exemption on non-concessional contributions

- The superannuation contributions work test exemption will be repealed for voluntary non-concessional, and salary sacrificed contributions for those aged 67 to 74 from 1st July 2022 (individuals will be able to make non-concessional contributions including the bring forward rule without meeting the work test which previously applied).

- The restrictions on non-concessional contributions for those with super balances above $1.6mil will continue to apply ($1.7mil in 2021-22).

Warning in respect of concessional contributions

The work test will still apply for individuals aged 67-74 in respect of personal concessional contributions.

Increased concessional and non-concessional caps

From 1 July 2021:

- Concessional Contributions Cap is increasing from $25,000 to $27,500.

- Non-concessional Contributions Cap is increasing from $100,000 to $110,000.

The bring forward rule

- The bring forward rule enables you to contribute up to three years’ worth of non-concessional contributions in the one year. That is, from 1 July 2021, you could contribute up to $330,000 to your superannuation in one year. You can use the bring forward rule if you are 64 or younger (for 2021-22 year) on 1 July of the relevant financial year of the contribution and the contribution will not increase your total super balance by more than your transfer balance account cap.

- If you utilised the bring forward rule in previous years, your non-concessional cap will not change. You will need to wait until your three years has expired before utilising the new cap limit.

Residency rules in relation to SMSF's to be relaxed

- The safe harbour that currently allows central management and control of the fund to be out of the country for 2 years will be extended to 5 years from 1 July 2022.

- The SMSF residency test is currently set out in the definition of "Australian superannuation fund" under s295-95(2) of the ITAA 1997. Complying superannuation fund status, and concessional tax treatment, is restricted to “resident regulated superannuation funds” that satisfy the definition of an “Australian superannuation fund”.

- The Government said the proposed changes to the residency requirements will allow SMSF and SAF members to continue to contribute to their superannuation fund whilst temporarily overseas, ensuring parity with members of large APRA-regulated funds. It will also provide SMSF and SAF members with flexibility to keep and continue to contribute to their preferred fund while undertaking overseas work and education.

Superannuation guarantee monthly limit

The $450 per month income threshold for Super Guarantee payments will be removed from 1 July 2022 (impacting approximately 300,000 employees 63% of whom are women).

SG contribution increase

Increases in the SGC will proceed as legislated in 2021-21 this will mean the minimum contribution is 10% up from 9.5%.

High income earner opt out of SG contributions with multiple employers

High income earners earning more than $275,000 with multiple employers will be able to opt out of SG contributions (the threshold was previously $263,157).

Downsizer contribution

- Eligibility age reduced to 60 in the financial year after royal assent is received.

- Other eligibility criteria include:

- An additional $300,000 cap in addition to your non-concessional contributions cap and must be from the sale proceeds of your home. Either the individual or their spouse must have owned the house for at least 10 years.

- The contribution must be made within 90 days of the property changing ownership and the contribution is capped at the amount of the proceeds received for the sale of the home.

- They are not restricted by the $1.6mil balance requirement like other non-concessional contributions however they will still count towards the transfer balance cap once inside super.

First Home Super Scheme

- To be extended for withdrawals up to $50,000

- Still needs to come from voluntary superannuation contributions (not SG).

- Voluntary contributions made from 1st July 2017 up to the existing cap of $15,000 per year will count towards the total amount able to be released.

- A person must be 18 years or over to participate.

- The scheme essentially is taxed at a 15% saving because withdrawals for a first home are taxed at the individuals' marginal rate less a 30% tax offset (having been taxed at 15% on the way in to super).

Other measures

Home Guarantees for Single Parents and New Homes

- New Home Guarantee is to be expanded for a second year, providing an additional 10,000 places for 2021-22 for home buyers building or buying newly built homes with as little as 5% deposit.

- Family Home Guarantee for Single Parents is to be established with 10,000 guarantees made available over 4 years to single parents with dependents. This will enable eligible people to buy a home with as little as 2% deposit.

Super and victims of domestic violence

The government will not proceed with the superannuation early release for victims of domestic violence

Transfer of unclaimed superannuation to KiwiSaver

The government will provide $11 million over 4 years to the ATO to administer the transfer of unclaimed superannuation directly to KiwiSaver accounts.