How Strong is the Australian Economy?

In this newsletter, we look at the recent strong growth in the Australian economy. The question is: Is this recent strong growth going to be sustainable in the medium term? I am sure that you were heartened by the 3.1% growth in GDP in the December quarter, which has meant that the overall growth for the 2020 year was only -1.1%.

I am sure you would agree, we are in a much better position than we were in July 2020 after a record -7% growth for the quarter. However, with the last two (2) quarters being in excess of 3% in both quarters, the Australian economy is pretty much back to the position it was pre the COVID-19 pandemic.

Although the recovery has been great news for Australia, we should note that 2020 was still the worst year since 1960 in terms of GDP per capita growth. GDP per capita in 2020 of $19,810 was 3.5% below what it was in 2019. By comparison, in the last 30-years, the next worst calendar year fall was 2.5% in 1991 during the recession.

In reality, most of our business clients have mostly recovered from the COVID-19 pandemic effects. However, I think we would acknowledge that we cannot get back the lost revenue and profit for the 2020 and perhaps even 2021 years. We still have not seen the full effect of the withdrawal of JobKeeper so although the property market is buoyant, it remains to be seen whether this is transformed into jobs. Remember, there are still almost 2 million Australians on JobSeeker, it doesn’t seem like many of these people will be getting a job anytime soon, so we may be 3-5 years away from getting back to having unemployment levels below 5%.

What does this mean for us?

Property market: My philosophy has always been, never buy in a hot property market, so make sure that you carefully consider any purchases in the coming months.

Funding Opportunities: There are always many business opportunities and because of the banks refusing to lend, there will be opportunities to vendor finance a possible business purchase.

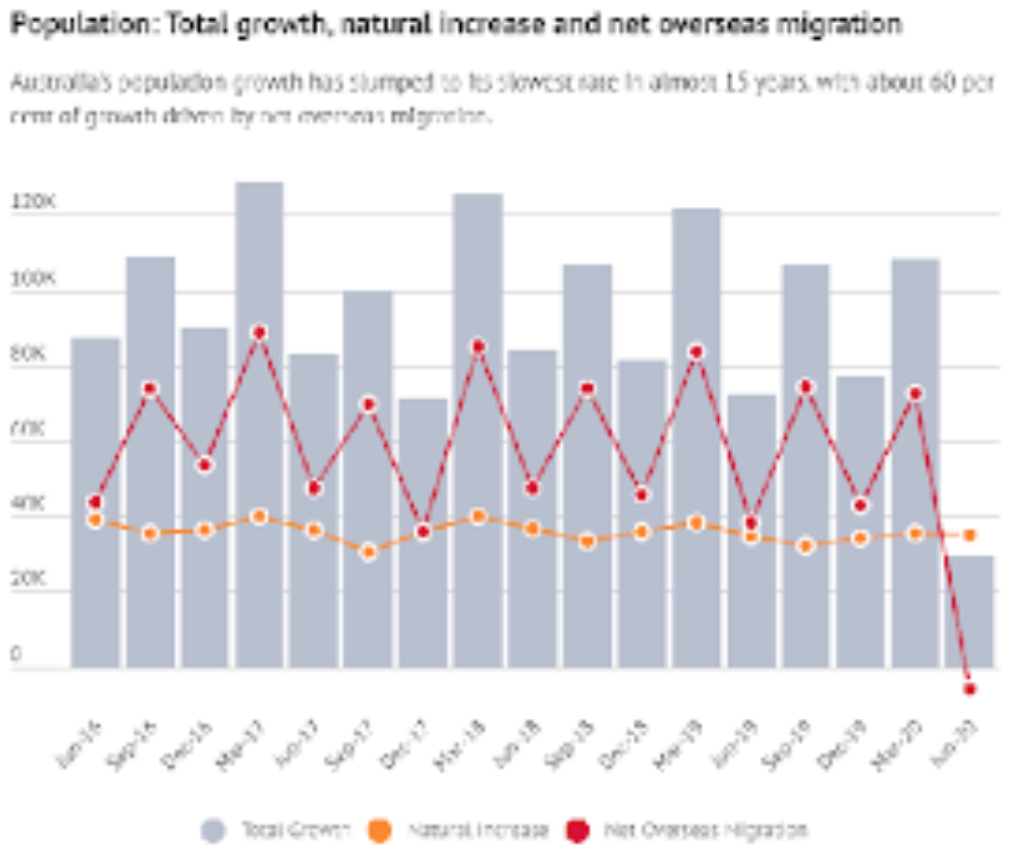

GDP Growth: Although the economy has recovered in nominal GDP growth, with net population growth now slowing to it lowest level in 15 years due to international border closures (don’t forget that 60 per cent of Australia’s population growth is driven by net overseas migration), expect that GDP growth per capita will continue to remain stagnant. This will no doubt have a subduing effect on the property market.

Although these factors may result in some subdued economic conditions in the coming few years, with an ageing population there are still so many opportunities to be a part of a transition of business ownership from one generation to the next (by the way, we can assist you from a professional level with any acquisitions you may have).

OTHER MATTERS

If you have not yet provided us with your information to have your 2020 financials and/or tax return completed, the month of March is a good month to organise this. Remember, if you get us your information on 1 May, we cannot guarantee that you will meet your lodgement due date obligations.