You are right about the economy being weak

Just a follow on from last month’s newsletter, where I discussed about the fact that Australia has been in a per capita recession for the last 6 quarters. The most recent GDP figures have just been released (4 December 2024) and indicate the following:

- The Australian economy rose 0.3% in seasonally adjusted chain volume measures

- In nominal terms, GDP rose 0.4%

- The terms of trade fell 2.5%

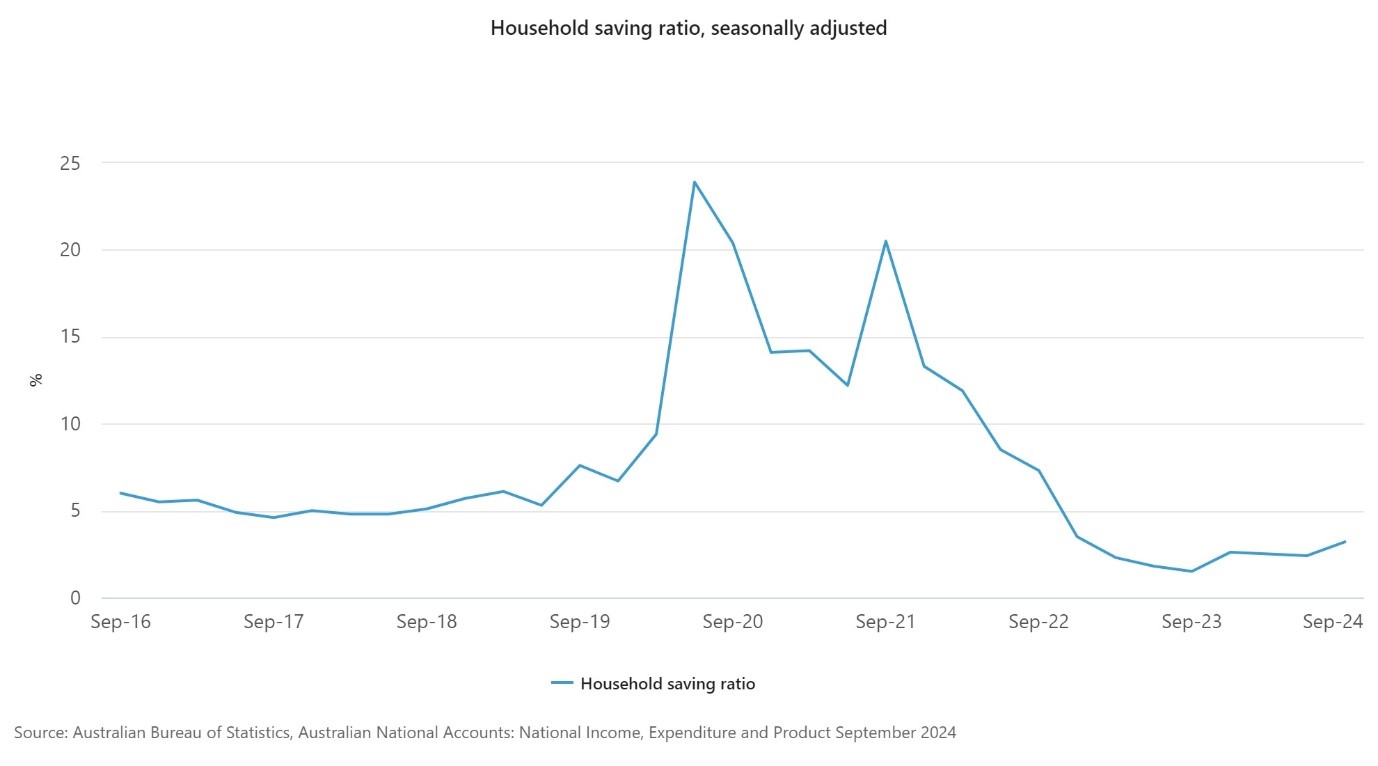

- Household saving to income ratio rose to 3.2% from 2.4%

- GDP per capita fell by 0.3 per cent, falling for the seventh straight quarter.

The yearly GDP for Australia only grew 0.8% to the end of September 2024. If you look at these figures more closely, the strength of the economy this quarter was driven by public sector expenditure with Government consumption and public investment both contributing to growth (Government spending rose by 1.4 per cent this quarter).

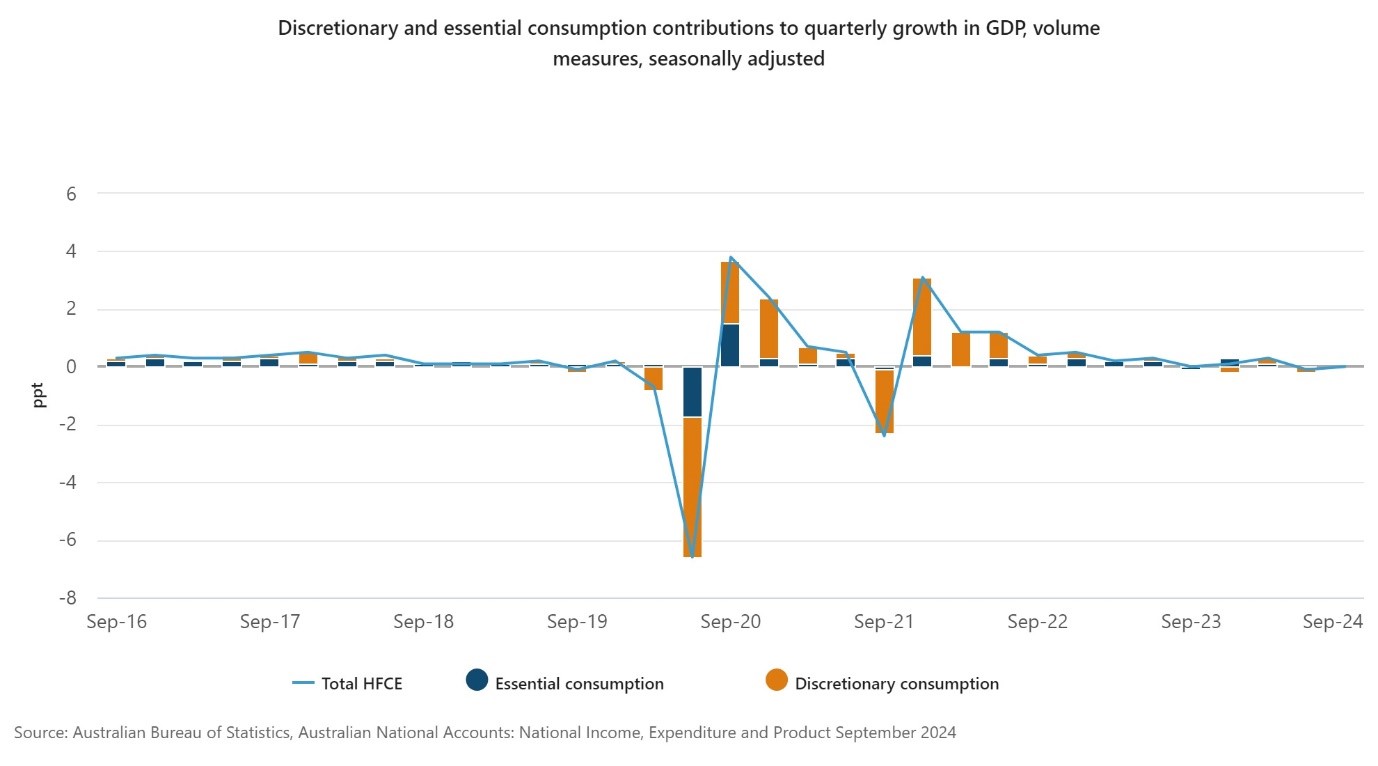

The below graph indicates what the Reserve Bank, and its hard stance on interest rates, have done to GDP growth through creating a marked drop in discretionary and essential consumption.

Now most of us in the real economy are wondering why this hard stance is improving our day-to-day living. We are told that there is a philosophical reason to keep inflation at 2-3% even if it means that we put small businesses to the wall that rely on consumer spending.

The only marginally good news that I saw in the latest figures released is at least household savings have increased slightly, but they are much lower than they were in September 2020 and September 2021. In fact, since interest rates have increased - surprise, surprise - household savings have remained very subdued.

There is also some encouraging news which centres around the fact that market analysts are starting to talk about interest rate drops from as early as February 2025. By the end of the 2025 calendar year, we may be luck enough to have a cash rate 1% lower than what it currently is – let’s hope!

According to Canstar, here’s what the nation’s big four banks have to say about the RBA’s predicted movements into 2025:

- ANZ predicts that the current level of 4.35% will be the cash rate’s peak, with the first cuts to start around May of 2025.

- CommBank predicts that the current level of 4.35% will be the cash rate’s peak, and that the first cut is likely to occur in February of 2025.

- NAB economists predict that the current level of 4.35% is the cash rate’s peak, with the first cuts to occur around May of 2025.

- Westpac predicts that the current level of 4.35% will be the peak, and that we might expect the first rate cuts to occur around May 2025.

My Christmas message is, hang in there until the New Year. Enjoy time with your family. Hopefully, we will have more money in our pockets by the end of 2025!

On behalf of the team at WSC Group, it has been a privilege looking after you this year. We are looking forward to a more positive 2025.