Budget Snapshot: Changes you need to know

I am sure you have now absorbed all the announcements that the politicians have made this Budget time, but if you haven’t, I thought I would outline some of the main changes that would affect you from a tax point of view as we approach 1 July 2023.

Small Business Depreciation Rules

As we have been speaking about recently during meetings with clients, we were always convinced that the temporary full expensing of depreciable assets was coming to an end as at 30 June 2023. We can now confirm that this is officially the case.

The good news is that for businesses that turn over less than $10m, they will still have access in the 2023/24 financial year to a $20,000 instant asset write-off. That is, for individual assets under $20,000 + GST purchased and installed between 1 July 2023 and 30 June 2024, there will be a 100% write-off. For assets over $20,000 + GST, you will be able to claim depreciation at small business pool rates with 15% being claimed during the first year and 30% being claimed in the subsequent year. This means that the assets above $20,000 will be written off over four (4) years.

If you turn over more than $10m per annum, you will calculate depreciation on the effective life of the asset and the ATO has effective life rates that we can use to make these calculations.

Small Business Energy Incentive

This applies to most of our clients as it is for businesses that turn over less than $50m. They will be able to claim an additional 20% deduction up to $100,000 (maximum bonus deduction of $20,000) on equipment that supports electrification and energy efficiency. We know that it includes items such as fridges, heat pumps and cooling systems. We will provide updates should additional inclusions apply such as solar panels, etc.

Tax Breaks for Build to Rent Development

Please note that this is only available for built-to-rent developments where 50 or more dwellings are made available to rent to the general public. Please note that the dwellings must be retained under single ownership for at least 10 years before being able to be sold. The measures revolve around increasing the rate of depreciation from 2.5% to 4% and reducing the final withholding tax rates from 30% to 15%.

If you believe that you fall into this category, please contact us to discuss. We envisage that most of our clients will not be able to take advantage of this measure.

Small Business Lodgement Amnesty

If you have not lodged Business Activity Statements or Tax Returns between 1 December 2019 and 29 February 2022, there is an opportunity to catch up and lodge outstanding statements and tax returns without paying penalties for late lodgement.

You will still need to pay any outstanding tax, but at least additional ATO costs for late lodgement penalties and interest penalties will not apply.

Retirees

For those who receive pensions, they will be happy to know that the work force participation incentive has been extend for another 6-months. This means that an individual can earn up to $11,800 before their pension is reduced.

Superannuation - $3m balance

For those who have individual members’ balances in excess of $3m, you will need to be aware that from 1 July 2025, that an additional tax rate on these balances will apply. If you fall into this category, please book in an appointment to discuss this with our financial planning team who will be more than happy to discuss the ramifications of this to your long-term retirement strategy.

Payment of Superannuation on Behalf of Employees

You should note that superannuation payments made on behalf of yourself, as an employee, as well as your employees, will need to be made with payroll from 1 July 2026. That is, if you pay your employees fortnightly, you will have to pay superannuation on behalf of employees fortnightly. It may be an idea to start thinking about adjusting your payments to incorporate this before it comes into effect from 1 July 2026.

Changes to Non-Arms’ Length Expense Rules

These were adjusted to become more reasonable if the ATO determines that some of your superannuation income is “non-arms’ length”. Please ensure that any rents charged to your business for property owned by your superfund are at a justified and market rent amount and that discretionary trust distributions are not made to your SMSF.

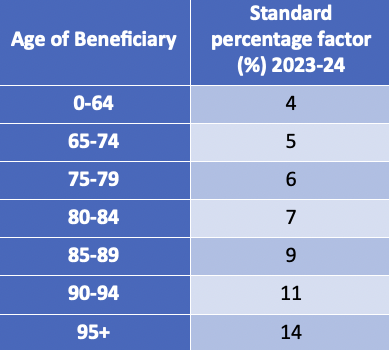

Minimum Drawdowns for Superannuation

It is important to note that minimum drawdown amounts have returned to normal rates having been halved in recent years. This means that from 1 July 2023, you will need to check with your Client Manager is for next financial year as, in most cases, it is going to be double the previous financial year.

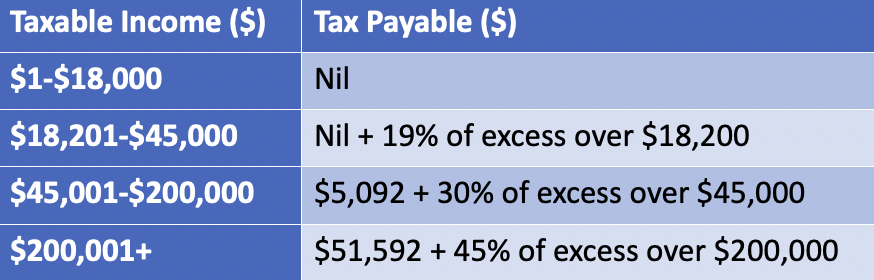

Stage 3 Tax Cuts – What this means for you

From 1 July 2024, the proposed tax cuts look like they are going to stay in place. This decision was no doubt made because personal tax receipts in the government budget are almost half total government revenue. In recent times there has been a lot of bracket creep – you pay more tax because tax rates are not adjusted in line with inflation – resulting in a budget surplus!

From 1 July 2024, if you earn between $45,000 and $200,000 that there will be a flat rate of tax between as the below table demonstrates. In many cases, although you will pay less tax, you will also receive less tax benefits on a negatively geared investment property.

Your WSC Group Client Manager will be more than happy to discuss this with you as part of your tax variation preparation process.

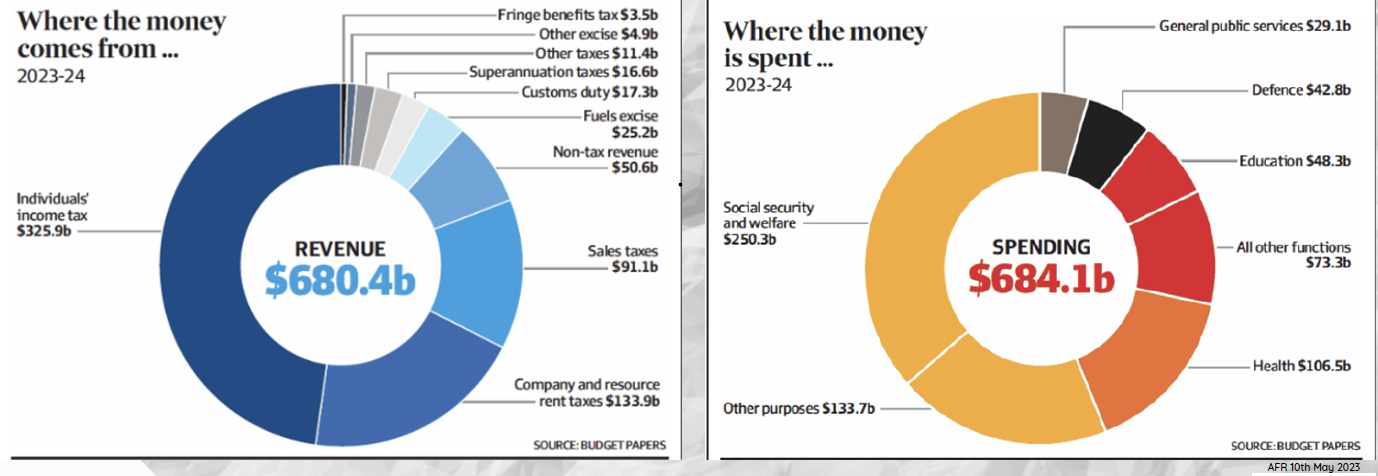

Where does Government revenue come from and where is it spent?

It is always good to look at this once a year. Some interesting statistics as per the below graph:

- Receipts into the Federal Government coffers are almost half from tax on individuals (47.8%)

- Of those tax receipts, about 77% of individuals income tax collected goes to social security and welfare.

- The Federal Government spends 2.4 times as much on social security and welfare than it does on health, nearly 5 times as much as it does on health and 6 times as much as it does on defence. Food for thought.

Tax Variations

With interest rates at 6%, it is now more important than ever to put together your information to get a tax variation prepared. For those of you who want more information regarding tax variations, you can watch our information video HERE. If you would like more information, please contact your WSC Group Client Manager in relation to this.

Tax time is just around the corner, and we are looking forward to catching up with you in person over the coming months.